How Can an Earned Wage Access Platform Help Your Business?

Earned Wage Access Platforms Improve Employee Retention and Morale

- What is Earned Wage Access Platform?

- What are the Benefits of an Earned Wage Access Platform?

- What to Look for in an Earned Wage Access Provider

- How to Implement Earned Wage Access

- A Look at Current Earned Wage Access Laws in the United States

- The Consumer Financial Protection Bureau (CFPB) Advisory Guidance on EWA

- Earned Wage Access Laws Across the US

- FAQ

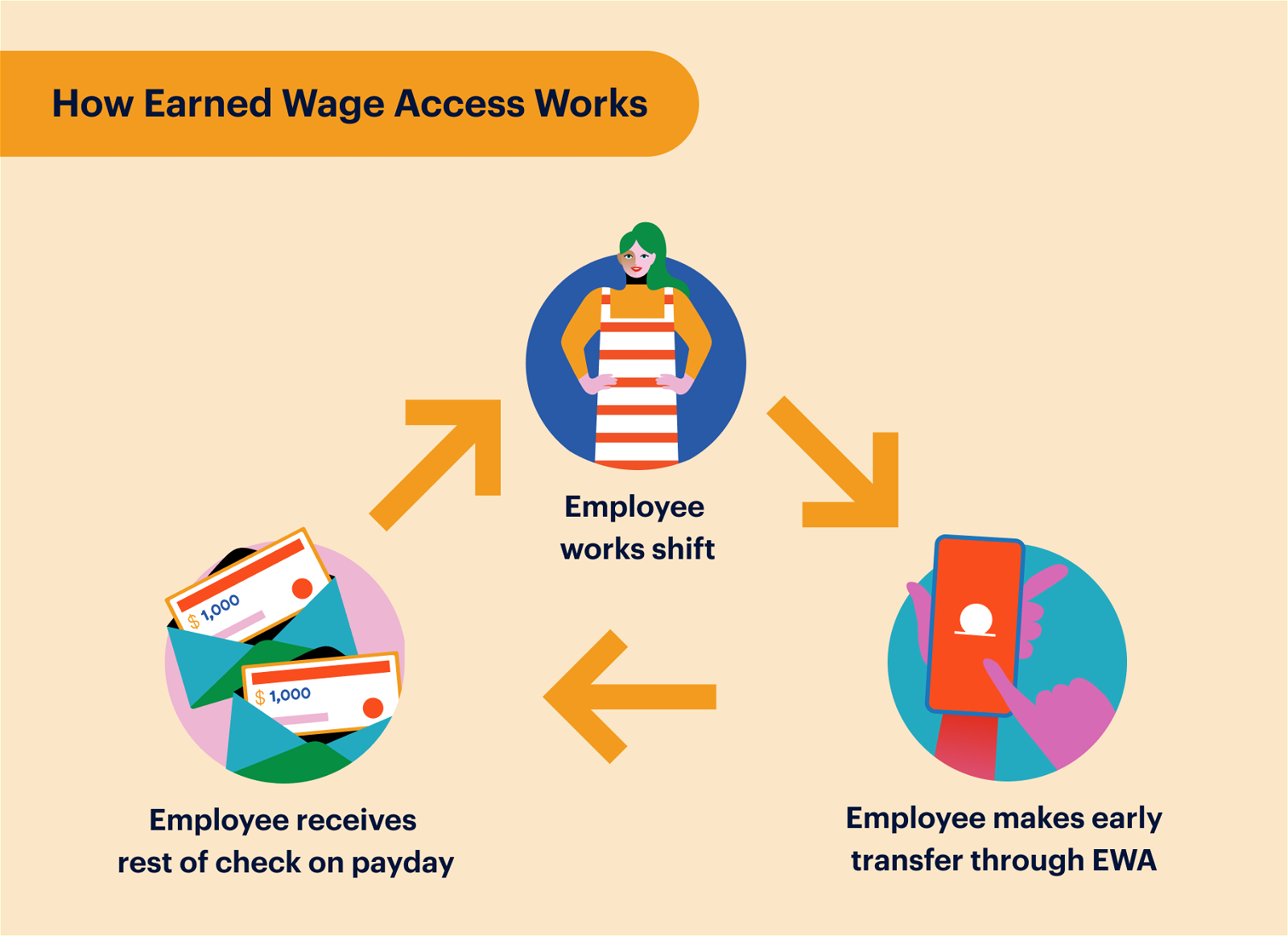

Earned wage access (EWA) — also known as on-demand pay — gives employees access to their earned pay before the traditional, scheduled payday.

With an earned wage access platform employers can provide greater financial wellness support for employees, leading to happier and more productive employees across an organization.

DailyPay was among the early pioneers of earned wage access platforms dating back to 2015. Today, earned wage access has become a must-have employee benefit. In fact, 76% of workers across all age groups say it is important for their employer to offer EWA according to a 2022 ADP Earned Wage Access Market Research Study.1

As the popularity of earned wage access increases, so have the regulations. Nevada and Missouri both recently passed laws around licensing processes and guidelines for earned wage access.2

What is Earned Wage Access Platform?

Earned wage access platform is a financial wellness benefit that lets employees choose when they get their earned pay instead of the traditional pay cycle. In other words, it allows employees to receive part of their paycheck before a scheduled payday.

This increased flexibility of their pay schedule allows employees to potentially improve their financial well-being and avoid predatory lending solutions that can damage their credit and rack up costly interest rates or other fees.

89%

of employees reported feeling more motivated and productive at work when they had access to their pay on their schedule.1

Today, it’s not a question of whether a company will adopt the benefit but when.

According to Fisher Phillips, 89% of employees reported feeling more motivated and productive at work when they had access to their pay on their schedule.3

Due to this increased demand, more employers are considering earned wage access as a benefit for employees, many of whom want greater flexibility in how they are paid.

What are the Benefits of an Earned Wage Access Platform?

Earned wage access has a variety of benefits for both employers and employees. Let’s take a look at some of the ways each can expect to see some rewards. Additionally, there may be some perceived cons your company should consider when looking into EWA.

Earned Wage Access Benefits for Employers

Aside from the employee desire for earned wage access, employers should recognize the benefits and consider how earned wage access will help their company overall.

63%

improvement in tenure rates by offering earned wage access.2 Higher retention rates can reduce the costs of back-filling positions and improve morale.

Increased Employee Retention

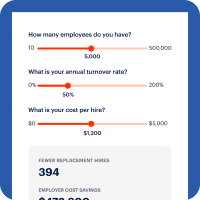

A DailyPay sponsored study from Mercator showed that earned wage access can improve tenure rates by 63%.4 Higher employee retention can reduce the costs of back-filling positions and improve morale.

Higher Employee Engagement

Research sponsored by DailyPay found that when people worry about finances at work, they’re less engaged.5 An outstanding employee experience may help employees feel valued, engaged and supported leading to better employee retention.

Better Customer Outcomes

Employees who are more motivated, engaged and happy in their roles are more likely to deliver better experiences such as:

Earned Wage Access Benefits for Employees

Financial stress is one of the most common reasons for employee turnover. According to the 2022 PWC Employee Financial Wellness Survey, financially stressed employees are twice as likely to look for a new job.6 Employees struggling with financial considerations have higher stress levels,7 and this can negatively affect their morale and productivity.

More Than

8 in 10

employers believe employee financial wellness programs and tools help to create more productive, loyal, satisfied and engaged employees.6

According to a 2020 study by SHRM, more than 8 in 10 employers believe employee financial wellness programs and tools help to create more productive, loyal, satisfied and engaged employees.8

What to Look for in an Earned Wage Access Provider

When selecting an earned wage access provider, evaluate various aspects of the experience for your company.

- Consider the vendor’s experience when dealing with the regulatory environment.

- Determine if the vendor has experience dealing with companies of your size and if they will meet your needs.

- Ensure the earned wage access provider can help improve the overall employee experience.

- Evaluate the security and privacy standards and how they protect sensitive information.

So how does on-demand pay from DailyPay stack up against other major earned wage access providers in the market?

The following table provides a fact-based evaluation of earned wage access vendors for your consideration.

Sources: DailyPay;

Payactiv; Branch;

Ceridian

https://www.dayforcewallet.com/organization

https://www.ceridian.com/uk/products/dayforce/payroll/wallet-on-demand-pay

https://www.zdnet.com/finance/banking/ceridian-redefines-how-employees-get-paid-with-its-dayforce-wallet/

How to Implement Earned Wage Access

Getting started with earned wage access involves planning and collaboration across internal staff and your vendor. During the earned wage access implementation process you should consider vendor partnerships, industry requirements, security and more.

Luckily, the more established vendors like DailyPay make implementation simple and easy.

DailyPay has developed an integrated solution with many payroll providers, which may reduce the implementation time to two weeks. DailyPay will work with you throughout the implementation process to ensure a smooth adoption of earned wage access throughout kickoff, testing, transmission, training and launch.

Get More On-Demand Pay Insights.

Thanks for subscribing!

You’ll start receiving on-demand pay resources soon.

A Look at Current Earned Wage Access Laws in the United States

Earned wage access has continued to grow in popularity as a financial wellness tool for employees and a difference-maker for employers when it comes to recruiting and employee retention.

This rise in popularity has also come with an increase in new laws that license earned wage access as its own financial product to codify industry best practices and protect consumers.

Current State-by-State Earned Wage Access Laws

In the United States, Nevada and Missouri enacted laws in 2023 that licensed EWA as its own financial product. Wisconsin did so as well in 2024.

Both licensing laws require important disclosures in order to ensure strong protections for all EWA consumers.

DailyPay was an active part of the broad coalition of stakeholders that helped to develop and ultimately enact both bills. Throughout the country, DailyPay proactively engages with regulators and legislatures on EWA public policy and other issues.

Nevada EWA Laws

In 2023, Nevada passed and signed into law, with overwhelming bipartisan support, SB290 – the country’s first bill regulating earned wage access products.11

Missouri EWA Laws

Soon after Nevada, Missouri became the second state to enact an EWA licensing law. SB103 was passed with strong bipartisan support.12

Wisconsin EWA Laws

Wisconsin Governor Tony Evers signed Assembly Bill (AB) 574 into law in March 2024, representing the country’s third law licensing earned wage access as its own financial product. It follows in the footsteps of Nevada and Missouri – codifying industry best practices to require meaningful consumer protections that exist in our model and that will now expand them for users of other models. This also serves as another data point validating EWA as a crucial part of employers’ benefit suites.

The Consumer Financial Protection Bureau (CFPB) Advisory Guidance on EWA

In 2017, the Consumer Financial Protection Bureau (CFPB) first commented on EWA when it issued guidances on payday loans and explicitly exempted EWA from this rules. Then in 2020 the CFPB issued advisory guidance regarding EWA programs and whether the Truth in Lending Act (TILA) applies. According to the guidance, EWA programs can be distinguished from being considered credit when certain key criteria is satisfied.

In their 2020 guidance, the CFPB indicates that programs that require an employee to pay back an on-demand transfer via a payroll deduction and charge fees may be considered extensions of credit unless, among other things, it is free of charge to the EWA user or if an undefined “nominal processing fee” is charged.

Earned Wage Access Laws Across the US

Every day, DailyPay works proactively with a diverse array of EWA stakeholders and policymakers.

Our work includes educating to those unfamiliar with EWA about its mutual benefits for both employers and employees:

- Employers see faster hiring and increased retention rates.

- Employees can avoid paying bills late and costly financial products like payday loans, overdraft fees and predatory credit financing.

Earned wage access as it is currently structured is not the future but a recognized and necessary solution for today. That’s why now is the right time for innovative companies to engage and deploy an earned-wage access platform.

Frequently Asked Questions

-

What is earned wage access?

Earned wage access is a financial wellness benefit that lets employees choose when they get their earned pay instead of the traditional pay cycle. Read more about what earned wage access is.

-

Is earned wage access the same as on-demand pay?

Yes, earned wage access and on-demand pay are different terms for the same benefit. Read more about what earned wage access is.

-

Which companies offer earned wage access? How does my company get earned wage access if we don’t currently have it?

Earned wage access through DailyPay is available to companies across the United States. Ask your payroll or human resources department if your company offers DailyPay.

-

How much does it cost to sign up for earned wage access?

There is no cost to your company when you sign up for DailyPay. Employees pay a small ATM-like fee of $3.49 for an immediate transfer or have a no-fee option for a transfer in one to three business days.

-

Is earned wage access the same as a payday loan?

No, earned wage access is a cost-effective alternative to predatory payday loans. Employees pay a small ATM-like fee for an immediate transfer or have a no-fee option for a transfer in one to three business days, which can save thousands of dollars and avoid damage to credit scores and financial health. Learn more about how DailyPay helps workers avoid the vicious cycle of predatory debt.

-

Why should a company offer earned wage access to their employees?

Earned wage access has various benefits for employers and employees. Increased retention, better productivity and greater financial wellness are a few of the notable benefits. Learn more about the benefits of earned wage access.

-

What is the difference between earned wage access and early wage access?

Some companies may offer “early wage access” which allows employees to get their direct deposit a day or two before the typical scheduled day.

-

What is “On-demand payroll” and is this the same as “earned wage access”?

“On-demand payroll” is often used as a synonym of EWA but it's a broader term. On-demand payroll can also include off-cycle payments and reward payment options.

-

Is “earned income access” the same as “earned wage access”?

Early income access is another term for earned wage access. It may also be referred to as on-demand pay.

-

Are there fees associated with earned wage access?

Yes, there are fees just like using an ATM, but we offer a no-fee EWA transfer option (1-3 business days). Learn more about no-fee EWA. -

What are earned wage access apps?

EWA providers feature apps where users can track their earnings, save money and make transfers to the account or card of their choosing. Learn more about the EWA app. -

What is earned wage access software?

While it is often referred to as software, EWA is a tool that can be integrated in existing softwares such as payroll. EWA “software” is an app where employees can make transfers of their earned wages and track spending.

Explore More about Earned Wage Access

See Why Top Companies Choose DailyPay

Empowering for Employees

Greater financial control with access up to 100% of their DailyPay balance to meet the challenges of unexpected financial disruptions.

Improved planning with visibility to spending and earned pay in one easy-to-use app.

No need for a pre-existing checking or savings account.

Simple and Secure for Employers

Minimal change to payroll processes — DailyPay handles it all.

Seamless integration with HCM, payroll, banking and benefit applications.

Enterprise-grade platform that keeps data private and the service running so it's always there when your employees need it.