The terms earned wage access (EWA) and paycheck advances are occasionally used interchangeably, but this conflation is inaccurate as they serve distinct purposes and operate differently. The fundamental difference lies in the timing of accessing funds and the financial implications for employees, making it crucial to differentiate between the two to avoid confusion and ensure fair treatment of workers.

EWA and paycheck advances are two different financial benefits that offer employees early access to their earnings, but they have very different features that make earned wage access for payroll a more favorable option for both employees and employers.

Here’s why:

For Employees

Paycheck advances are often seen as a last resort for workers facing financial emergencies, indicating a breakdown in their financial stability. While providing immediate relief, they can create a cycle of dependency and financial strain for employees.

EWA offers financial control and flexibility while advanced payroll does not: EWA payroll allows employees to track, save, and spend their earned wages on their own schedule without having to wait for payday. This offers greater control over finances, not just a way to get money early.

It is helpful for unexpected expenses or emergencies – reducing the need for high-interest loans or credit card debt – but also allows employees to know their pay every day and better plan their finances.

EWA offers reduced financial stress: With EWA payroll, employees don’t have to wait for the fixed payday to address their financial needs. This can alleviate stress and anxiety associated with cash flow issues, leading to improved wellbeing.

According to an August 2023 DailyPay User Survey, 60% of DailyPay users surveyed say that DailyPay helps reduce their financial stress.1

EWA has no or low costs: Often, EWA services come with lower fees compared to traditional paycheck advances, which may include higher fees or interest rates. The best EWA services even offer fee-free access to earned wages.

No debt implications with EWA: EWA is not a loan; it’s access to wages that have already been earned. Therefore, it doesn’t create debt or impact credit scores, which is a significant advantage over paycheck advances that are essentially short-term loans.

According to a Mercator Report survey, 77% of users surveyed by Mercator said that they believe DailyPay helps them save money by avoiding other more expensive alternatives.2

For Employers

For payroll departments, managing paycheck advances adds complexity to payroll processes, increasing administrative burdens and potential errors. Additionally, the need to handle such requests can disrupt normal payroll operations, leading to inefficiencies and delays in payroll processing. Overall, while paycheck advances may offer temporary relief, they represent a suboptimal solution for both employees and payroll departments due to their adverse long-term effects and operational challenges.

Seamless integration with payroll: Earned wage access can be highly beneficial for payroll departments as it addresses several challenges they commonly face. Many EWA services offer easy integration with existing payroll systems, making it a hassle-free option for employers to provide this benefit without significant changes to their payroll processing.

According to a Hanover Research Study, 49% of companies indicated that the earned wage access solution lessens the payroll team’s workload.3

EWA can also help alleviate administrative burdens associated with processing payroll advances or managing inquiries from employees seeking early access to their wages. By partnering with an earned wage access provider, payroll departments can streamline processes and reduce the time and resources spent on managing such requests.

No direct financial impact: EWA services are typically managed by third-party providers, meaning there’s no direct financial impact on the company.

In contrast, paycheck advances may require the employer to manage additional financial transactions. This adds burden to payroll teams and leads to complications due to laws surrounding payroll advances.

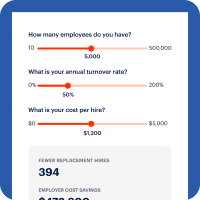

Enhanced employee attraction, retention, and productivity: Offering EWA can be an attractive benefit for current and prospective employees. It shows that the employer cares about the financial wellbeing of their staff, which can boost employee satisfaction and loyalty.

According to an ADP study, 96% of employers who offer EWA say it helps them attract talent, and 93% of employers who offer EWA say it helps them retain talent.4 According to a Hanover study, 94% of companies offering an EWA solution today believe it has a positive impact on workforce productivity.5

Positive company image: Offering modern financial benefits like EWA can enhance a company’s image as a forward-thinking and employee-first organization. Employees want to work for companies that prioritize employee financial wellness. Offering EWA can make you an employer of choice in any industry.

EWA platforms like DailyPay provide a more flexible, cost-effective, and risk-free option for employees to access their earned wages than payroll advances. For employers, it offers a valuable tool for enhancing employee wellbeing and productivity without significant financial or administrative burden.

1 DailyPay User Survey, August 2023:DailyPay, 2020

2 Customer Perceived Savings Report, Mercator Advisory Group commissioned by DailyPay, August 2022:DailyPay, 2020

3 Hanover Research Study: Companies with EWA Solutions, September 2023:DailyPay, 2020

4 ADP Earned Wage Access Market Research Study, March 2022 :DailyPay, 2020

5 Hanover Research Study: Companies with EWA Solutions, September 2023:DailyPay, 2020