How gainfully employed workers can be hit with bank overdrafts

Despite working full-time, many workers still confront financial hurdles, living paycheck to paycheck.

High living costs such as rent, utilities, and healthcare, can quickly deplete earnings. Unexpected expenses like car repairs or medical bills, further strain budgets. Limited savings exacerbate the situation, leaving workers vulnerable to overdrafts. Debt from student loans or credit cards adds to financial stress. Additionally, stagnant wages and inflation diminish purchasing power over time.

Without adequate financial wellness education or access to resources, workers may struggle to break free from this cycle.

Insufficient funds at the end of the month can precipitate costly overdraft fees, amplifying financial strain for individuals already struggling. When an account lacks adequate funds to cover transactions, banks typically charge overdraft fees, which can range from $25 to $35 per occurrence. These fees quickly accumulate, especially if multiple transactions trigger overdrafts.

For someone living paycheck to paycheck, these charges can significantly deplete already scarce resources, perpetuating a cycle of financial instability. Furthermore, overdraft fees compound the original deficit, exacerbating the challenge of recovering financially. High overdraft fees may force individuals to prioritize paying these penalties over other essential expenses, leading to further financial hardship.

This situation highlights the urgent need for comprehensive financial education and accessible banking solutions to empower individuals to manage their finances effectively and avoid these detrimental fees.

How do overdraft fees affect your employees?

If employees don’t pay their overdraft fees they can be charged multiple additional fees. If the overdraft fees aren’t paid in quickly or by a certain deadline, banks may even close employees’ whole accounts until they are paid.

If you have an employee struggling with overdraft fees, it could easily affect their personal lives which could float into their work performance. Next thing you know, they’re not as engaged in their work because they’re worrying about their finances. There should be a better alternative for employees rather than overdraft bank accounts.

Well… there is.

How can earned wage access prevent bank overdrafts?

Earned wage access or on-demand pay services offer a solution to prevent workers from overdrafting their bank accounts. By providing employees with the option to access a portion of their earned wages before the regular payday, companies can help bridge the gap between expenses and income. This flexibility allows workers to address urgent financial needs without resorting to overdrafts or high-interest loans.

Similarly, shorter pay cycles, such as weekly or bi-weekly payments, can be advantageous as they provide more frequent access to funds, reducing the likelihood of running out of money before the end of the month.

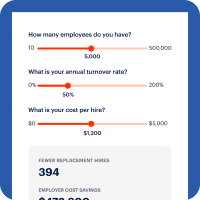

By implementing earned wage access programs or adopting shorter pay cycles, employers can support their workforce in managing their finances more effectively, alleviating financial stress, and reducing the risk of overdrafts.

When it comes to overdraft fees, DailyPay’s EWA platform can help save the day. DailyPay is an earned wage access platform that helps employees access their earned wages when they want to. It can eliminate overdraft fees since their earned wages will be made available after they work, ahead of payday.

According to a survey by Arizent, 75% of American healthcare workers said since using DailyPay, they either stopped or reduced paying overdraft fees.1 By using DailyPay, employees may lower the risk of being subject to overdraft fees

Have your employees’ hard work pay off on the daily with DailyPay.

1 Source:PR Newswire, Healthcare Workers Have Less Credit Debt and Pay Fewer Late Fees and Overdraft Fees When They Use DailyPay, December 2023