On March 30, 2020, DailyPay conducted a randomized sample survey of 6,950 active users who had used DailyPay in the last 3+ months. The goal of the survey was to determine the actual monetary impact that DailyPay has on our users and to determine how DailyPay affected their financial security.

The survey received an impressive 24% response rate (1,690 users), but what was even more impressive was data that the survey uncovered.

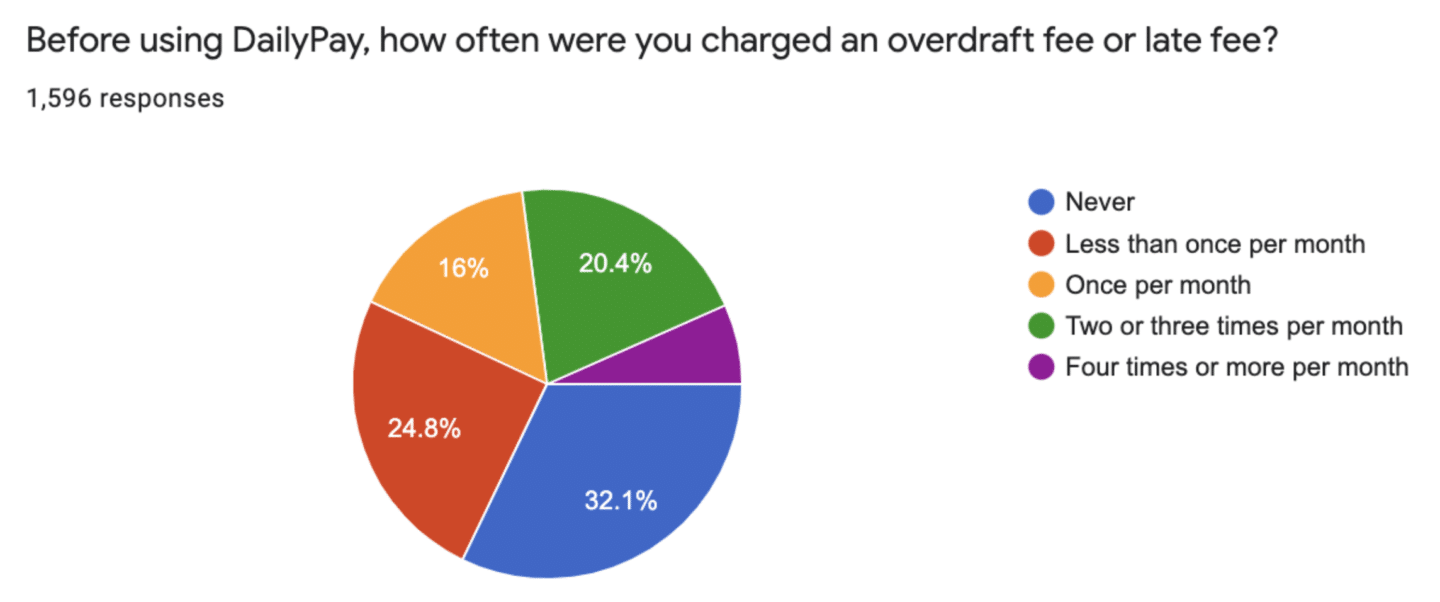

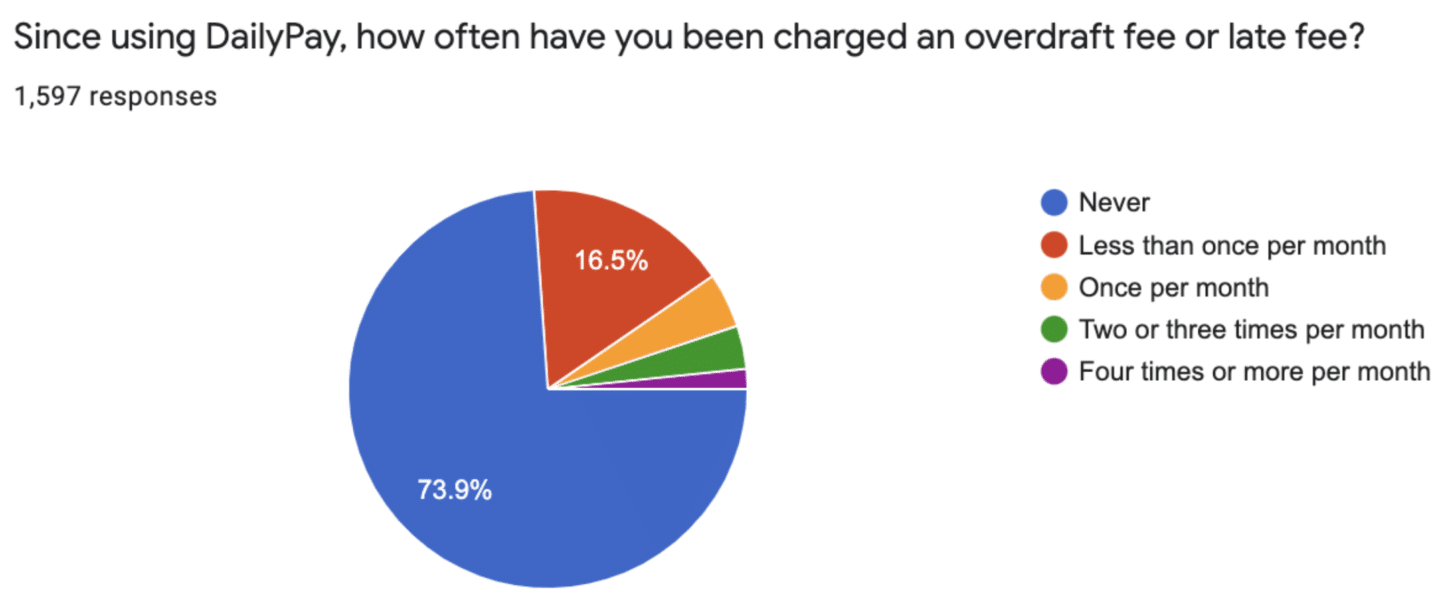

Question 1: How often have you been charged an overdraft or late fee?

Before Using Daily Pay

Key takeaway: Before using DailyPay, 2 out of 3 respondents reported that they were being charged overdraft fees or late fees.

Key takeaway: Before using DailyPay, only 32% of people had “never” incurred an overdraft or late fee. After using DailyPay, that number more than doubled to 74%.

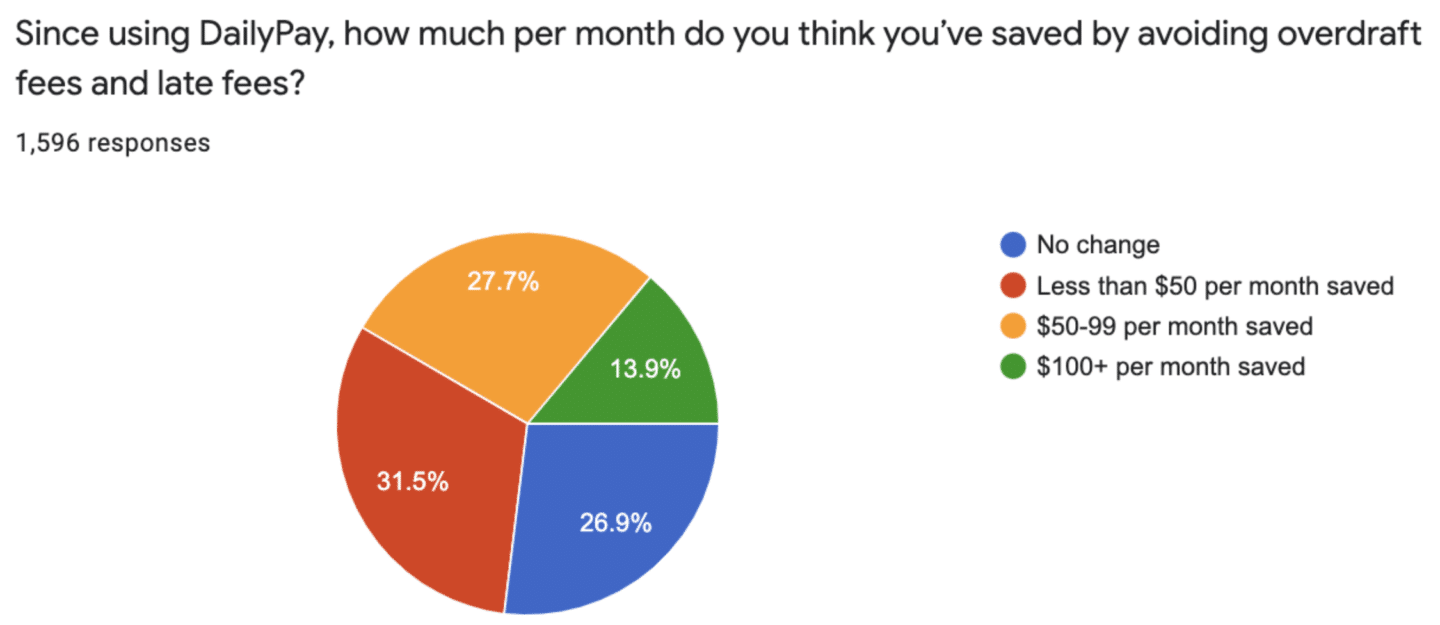

Question 2:

Key takeaway: DailyPay has helped employees avoid an average of $49.43 in fees, per month, from overdraft and late fees, or $593 per year.

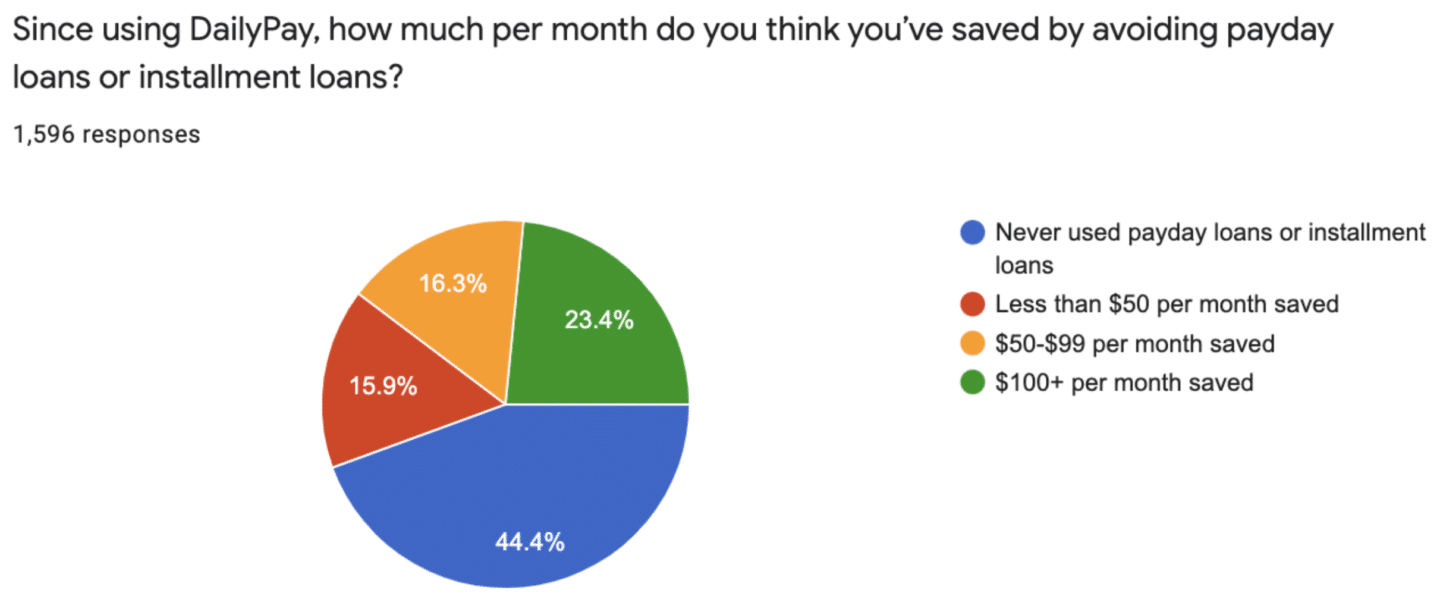

Question 3:

Key takeaway: DailyPay has helped employees avoid an average of $51 in fees, per month, from payday loans, or $612 per year.

What this survey is telling us is that DailyPay is saving employees, on average, $1,205 per year in reduced fees from loans, overdraft fees and late fees.

Additional survey results from respondents:

- 85% of users said DailyPay makes them more able to budget and pay large monthly bills like rent, utilities, car payment, etc. (vs. only 4% says it makes them less able)

- 78% said that DailyPay helps them pay bills on time and avoid late or overdraft fees

- 74% said DailyPay has helped reduce their financial stress

- 70% said DailyPay has helped them to avoid taking out a payday loan

- 59% said DailyPay motivates them to go to work

- 56% said DailyPay motivates them to pick up more shifts or work longer hours

- 51% said DailyPay has helped improve their financial health

- 50% said DailyPay has helped them be more disciplined about spending

- 46% said DailyPay has helped them to save more

In April, we conducted a second user survey to ask questions related to the impacts of COVID-19 on DailyPay users’ work and life.

16% of respondents reported that they applied

to their current jobs because they offer DailyPay.

Over half of those respondents work in the on-demand space for companies in food delivery and security; the remainder primarily working in healthcare or home care.

In addition, we asked, “Does having access to DailyPay during the COVID-19 pandemic reduce your financial stress?” 90.1% of respondents answered, ”yes.” Compare this with the 70% above who said “yes” under normal circumstances and you can see how critical on-demand pay is in emergency circumstances in reducing financial insecurity.

These surveys of DailyPay users are proof positive that access to earned income is critical to employees who live paycheck to paycheck and who rely on a daily pay benefit to pay bills on time and avoid overdraft fees, late fees and predatory payday loans. DailyPay is, therefore, not only a less expensive alternative to other means to obtain cash, it puts employees’ own money into their wallets as they need it. This was especially true during the current pandemic when users needed access to earned income both to make necessary preparations and to keep their families safe.

The survey results also address the concerns of both employers and policymakers who wonder whether access to earned income causes irresponsible spending. It is clear from this data that the answer is an overwhelming “NO!” The fact that 85% of users are better able to make large monthly payments, like rent, car payment and utilities on time proved that access to their earned income actually makes them more responsible, saving them a whopping $1,205 per year in fees associated with overdrafts, late payments and payday loans!

Want to get started on helping your employees to save more of their own money by offering them access to their earned income, with no changes to your payroll processes?

SCHEDULE A DEMO