Travel & hospitality

Happier Employees. Happier Guests.

On-demand pay benefits can address hiring shortage issues and improve employee engagement.

Overcome Challenges

The labor shortage isn’t going away any time soon and travel and hospitality companies are particularly vulnerable.

A reluctant labor pool and poor retention rates are two of the main struggles the industry faces as it tries to win back workers.

That’s why leading travel and hospitality companies are using DailyPay to quickly attract workers and retain their employees. In fact, businesses with job listings that mention on-demand pay through DailyPay fill open positions in half the time as those that don’t.1 And once they join, retention rates increase up to 72%.2

Attract More Employees with On-Demand Pay

Travel and hospitality companies are all striving to find new ways to overcome their hiring struggles and fill job vacancies to beat the competition.

On-demand pay can improve employee satisfaction and engagement, resulting in reduced turnover and better hiring rates.

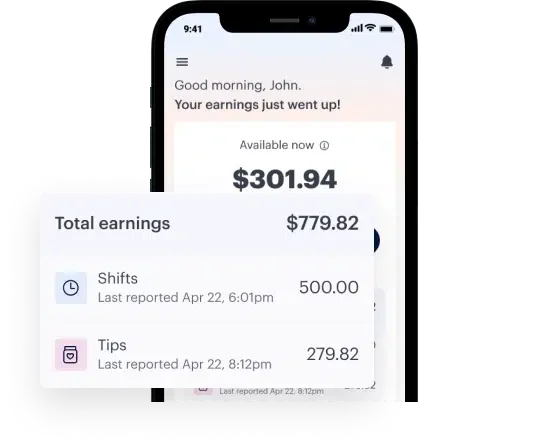

Advertising DailyPay in job listings fills positions in half the time.

72%

of employees want access to their wages before payday, according to DailyPay research.3

3 Source: Kronos, 2019

Improve Employee Satisfaction

Unsatisfied employees may lead to poor workplace morale and high turnover rates that result in poor customer service.

Benefits such as on-demand pay support employees with access to their earned wages, giving them more control over their finances.

With an on-demand pay solution like DailyPay, travel and hospitality companies can increase employee happiness to help reduce turnover costs.

21%

profit reduction in companies with unhappy employees.

$550B

in potential costs associated with low-employee engagement.4

4 Source: DailyPay

Success in Hospitality with On-Demand Pay

On-demand pay through DailyPay makes a noticeable impact on employee financial well-being. 73% of employees have an improved opinion of their employer thanks to on-demand pay through DailyPay.5 Employees can also build savings accounts and access benefit and reward payments to further increase job satisfaction.

Reduced Turnover

There is up to 72% less turnover in DailyPay users, potentially saving you millions each year.5Improved Productivity

56% of users say DailyPay motivates them to pick up more shifts and 59% say it motivates them to go to work.6Higher Guest Satisfaction

According to research, guests who experience great customer service are 10% to 30% more loyal.7Faster Hiring

Advertising DailyPay in job listings fills open positions in half the time. Beat the competition and avoid staff shortages.8Travel and Hospitality Companies Trust DailyPay

Top hospitality companies trust DailyPay to deliver on-demand pay to their employees.

DailyPay Integrates with Payroll and Attendance Systems

Partnering with DailyPay requires no additional work to implement and administer an on-demand pay program. Integrations are seamless and painless.

real lives. real results.

Why Employees Love DailyPay

“Using DailyPay has been an amazing benefit to my family and me…Certain months, every bill just happens to line up on the same day. It’s nice to be able to use DailyPay to be certain that, not only are our bills for the month covered, but so are everyday necessities.”

Have Questions? We Have Answers.

-

How can DailyPay help us stand out as an employer in the hospitality industry?

DailyPay can help you stand out among your competition in the hospitality industry. According to DailyPay research, job listings that mention on-demand pay through DailyPay fill open positions in half the time as those that don’t.

-

How can DailyPay help us fill shifts?

In addition to filling job listings in half the time with DailyPay, employee retention rates increase up to 72%, helping to reduce staffing shortages.

-

How can DailyPay help with time clock compliance in the hospitality industry?

In order to use to use DailyPay and make transfers, users need to correctly clock their hours. DailyPay has seen that employees who use our products are much more diligent about inputting hours. This means that your payroll team will spend less time processing costly off-cycle payments.

-

How many employees does my company need to have to offer DailyPay?Currently, DailyPay is only available to companies with 500 or more employees.

Resources for Travel and Hospitality

Click and scroll

Get More

On-Demand Pay Insights.

Thank You for Submission

Thanks for subscribing!

You’ll start receiving on-demand pay resources soon.

Thank you.

We will get back to you soon to schedule your demo.

Thank you for your interest in the On-Demand Pay International Council!

We will get back to you in 2-3 business days.

Get DailyPay for Your Business

Experience what the gold standard in on-demand pay can do for your business and your employees.