How Can Earned Wage Access Help Your Business?

Earned Wage Access Improves Employee Retention and Morale

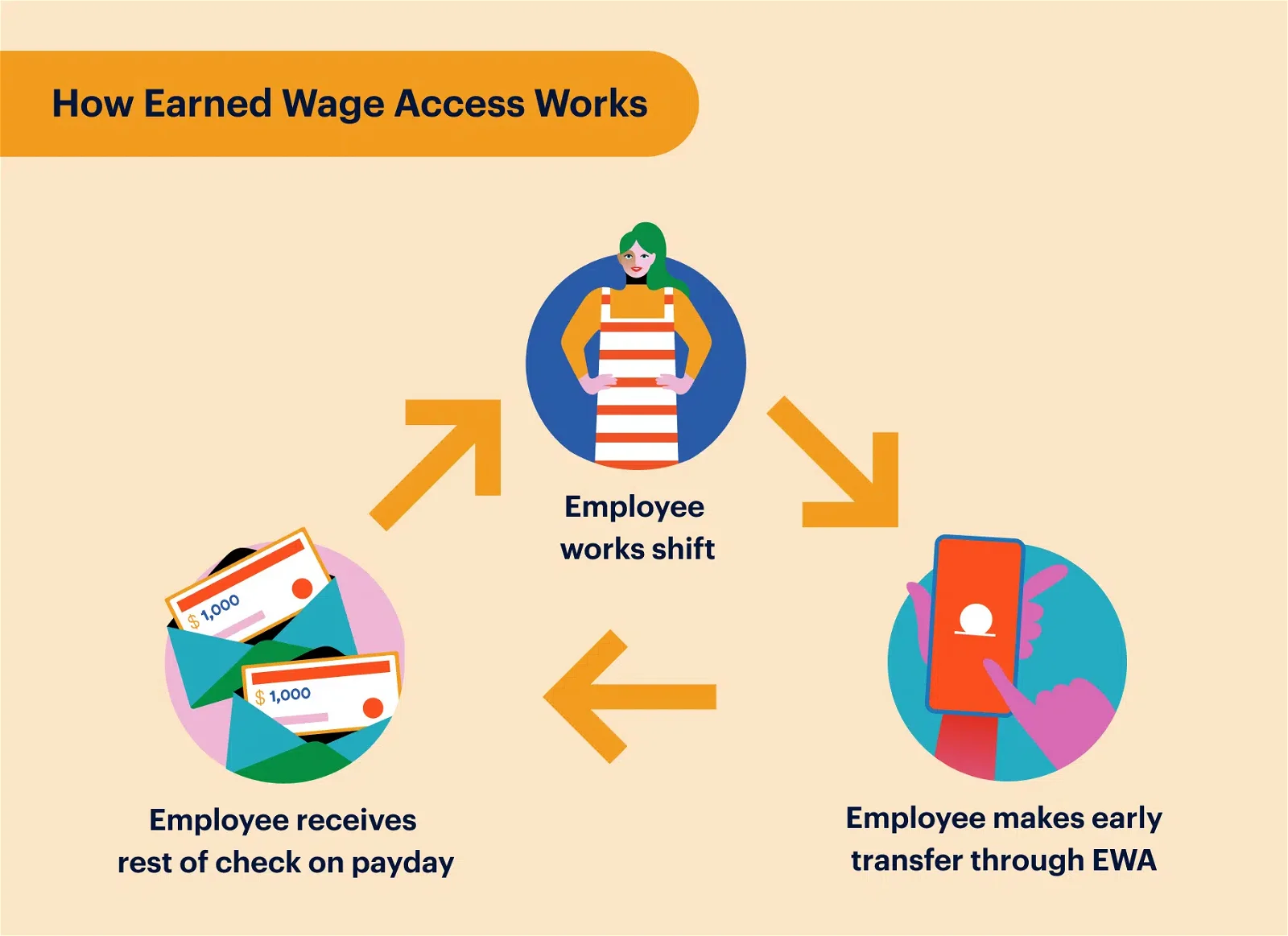

Earned wage access (EWA) — also known as On-Demand Pay — gives employees access to their earned pay before the traditional, scheduled payday.

With earned wage access, employers can provide greater financial wellness support for employees, leading to happier and more productive employees across an organization.

What is Earned Wage Access?

Earned wage access platforms let employees choose when they get their earned pay instead of the traditional pay cycle. This increased pay flexibility allows employees to potentially improve their financial wellness and avoid predatory lending solutions that can damage their credit and rack up costly interest rates or other fees.

Today, it’s not a question of whether a company will adopt the benefit but when. Nearly half (49%) of DailyPay users say earned wage access makes them feel more motivated at work.1

Earned Wage Access for Small Businesses

For small business employers looking to gain a competitive edge in hiring and support their employees’ financial wellness, DailyPay is the only provider that integrates seamlessly with your payroll provider, is available at no cost to you, and requires no changes to your payroll processes.

Does your business use ADP, Paychex or UKG?

What are the Benefits of Earned Wage Access?

Earned wage access has a variety of benefits for both employers and employees. Let’s take a look at some of the ways each can expect to see some rewards.

Earned Wage Access Benefits for Employers

Aside from the employee desire to access their earned wages when they need them, employers should recognize the benefits and consider how earned wage access will help their company overall.

Increased Employee Retention

Higher employee retention can reduce the costs of back-filling positions and improve morale.

95%

of companies offering an EWA solution today believe it has a positive impact on employee retention.2

Higher Employee Engagement

Research sponsored by DailyPay found that when people worry about finances at work, they’re less engaged.3 An outstanding employee experience may help employees feel valued, engaged and supported leading to better employee retention.

Better Customer Outcomes

Employees who are more motivated, engaged and happy in their roles are more likely to deliver better experiences such as:

Earned Wage Access Benefits for Employees

Financial stress is one of the most common reasons for employee turnover. According to the 2022 PWC Employee Financial Wellness Survey, financially stressed employees are twice as likely to look for a new job.4 Employees struggling with financial considerations have higher stress levels,5 and this can negatively affect their morale and productivity.

97%

of companies with an EWA solution indicated employee financial wellness has a positive impact on productivit y.6

What to Look for in an Earned Wage Access Provider

DailyPay was among the early pioneers of earned wage access platforms dating back to 2015. Today, earned wage access has become a must-have employee benefit. In fact, 53% of users surveyed say EWA is critical or very important to their future job considerations.7

- When selecting an earned wage access provider, evaluate various aspects of the experience for your company.

- Confirm the EWA provider has experience dealing with companies of your size and will meet your needs.

- Ensure the earned wage access provider can help improve the overall employee experience.

- Evaluate the security and privacy standards and how they protect sensitive information.

- Consider if the vendor integrates with your payroll and timekeeping platforms.

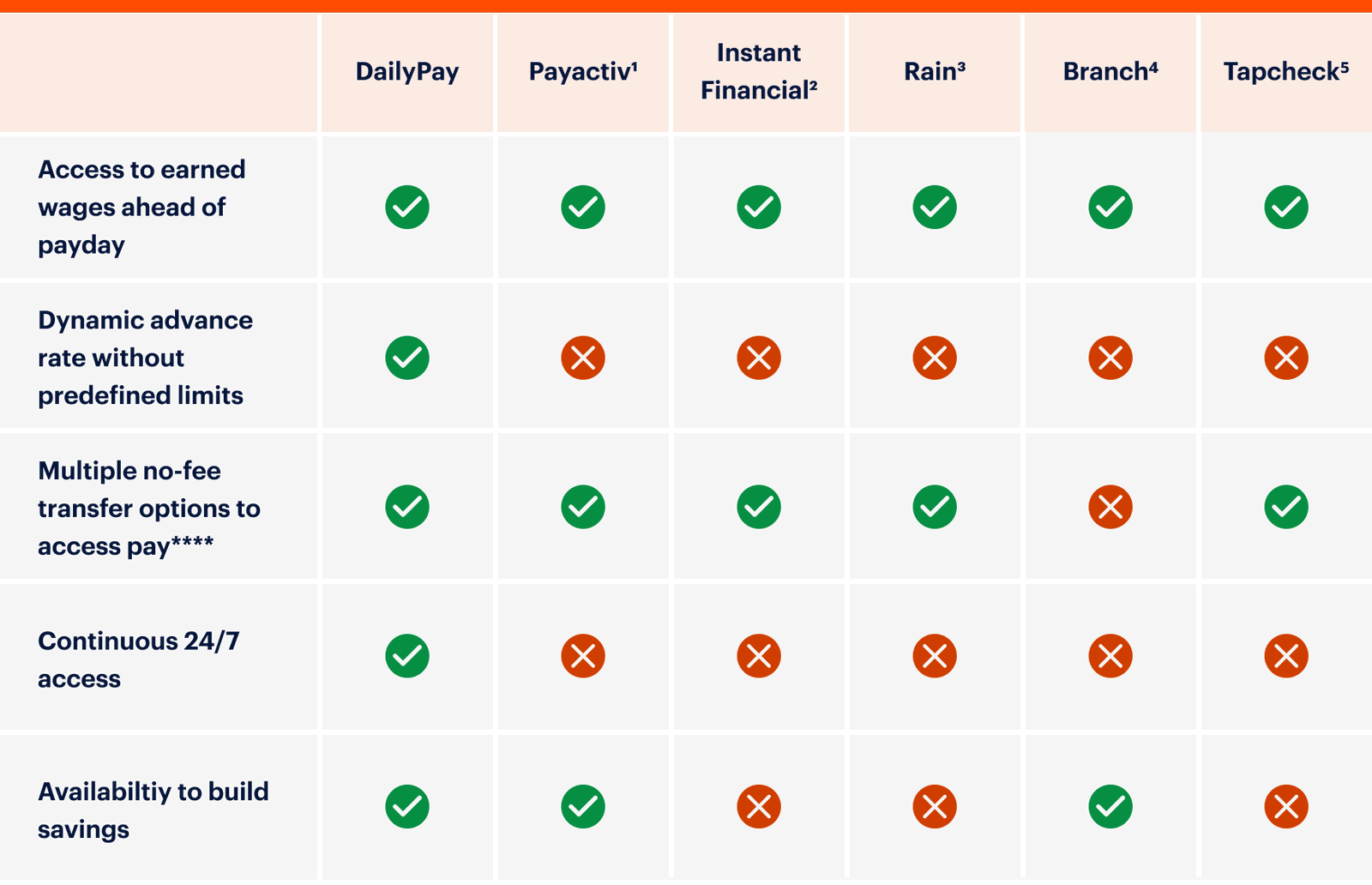

So, how does DailyPay stack up against other major earned wage access providers in the market?

The following table provides a fact-based evaluation of earned wage access vendors for your consideration.

View our competitor pages for a more detailed breakdown: Payactiv, Instant Financial, Rain, Branch and Tapcheck.

How to Implement Earned Wage Access

Getting started with earned wage access involves planning and collaboration across internal staff and your vendor. During the On-Demand Pay implementation process you should consider vendor partnerships, industry requirements, security and more.

Fortunately, established vendors like DailyPay make implementation simple and easy.

DailyPay has developed an integrated solution with many payroll providers, which may reduce the implementation time to two weeks. DailyPay will work with you throughout the implementation process to ensure a smooth adoption of earned wage access throughout kickoff, testing, transmission, training and launch.

Earned Wage Access Apps

Earned wage access apps provide employees with the ability to access a portion of their earned wages before the standard payday, offering a flexible and convenient solution to cash flow problems.

Earned wage access apps are especially useful for workers who may encounter unexpected expenses, such as medical bills or car repairs, and cannot wait for their regular paycheck to cover the costs.

Earned wage access apps can easily integrate with an employer’s existing payroll system and provide early access to earned wages to give employees more control over their finances. These apps allow employees to track earnings, access their earned pay, build savings, and improve their financial wellness.

Earned Wage Access Laws and Regulations Across the United States

Earned wage access (also known as On-Demand Pay) has continued to grow in popularity as a financial wellness tool for employees and a difference-maker for employers when it comes to recruiting and employee retention.

This rise in popularity has also come with an increase in new laws that license earned wage access as its own financial product to codify industry best practices and protect consumers.

DailyPay works proactively with various EWA stakeholders and policymakers.

Our work includes educating those unfamiliar with EWA about its mutual benefits for both employers and employees, including:

Employers see faster hiring and increased retention rates.

Employees can avoid paying bills late and costly financial products like payday loans, overdraft fees and predatory credit financing.

Earned wage access as it is currently structured is not the future but a recognized and necessary solution for today. That’s why now is the right time for innovative companies to engage and deploy an earned-wage access platform.

States With EWA Laws and Regulations

Nevada

Nevada passed the country’s first bill regulating earned wage access, SB 290.8

Missouri

Soon after Nevada, Missouri became the second state to pass and sign EWA legislation. SB 103 was passed with strong bipartisan support.9 The act outlines the obligations and restrictions on how an earned wage access services provider (“service provider”) may engage in business.

Wisconsin

In March 2024, Wisconsin licensed EWA as its own financial product. It follows in the footsteps of Nevada and Missouri — codifying industry best practices to require meaningful consumer protections that exist in our model and that will now expand them for users of other models. This also serves as another data point validating EWA as a crucial part of employers’ benefit suites.

Kansas

In April 2024, Kansas designated EWA as its own financial product. This legislation establishes clear standards for acceptable EWA services regulated under its registration regime in a manner that reflects the nuances and optionality of the EWA industry while also protecting consumers from irresponsible actors.

South Carolina

In May 2024, South Carolina enacted a law that regulates d EWA as its own financial product. This provides regulatory clarity that helps protect all EWA consumers in the state of South Carolina, while also promoting innovation.

California

In February 2025, new regulations came into effect in California regarding EWA. California’s Department of Financial Protection & Innovation (DFPI) became the first state financial administrative body to draft, amend, and ultimately adopt an EWA regulation outside of the usual legislative process. The industry-wide rules enable EWA to be available to residents of California, as long as operators comply with certain consumer protection requirements.

Arkansas

In March 2025, Arkansas passed a law regulating EWA. The measure appropriately regulates EWA as its own financial product, and creates a framework for protecting consumers while allowing for businesses to innovate.

Utah

The law codifies the EWA industry’s best practices into law, including recognizing EWA as its own financial product, and requires all EWA consumers to receive the same protections regardless of the product they’re using.

Indiana

In May 2025, Indiana passed regulation that classifies EWA as a unique financial product.

Maryland

In May 2025, Maryland passed a law deeming EWA different from traditional credit products. The law will take effect on October 1, 2025.

Louisiana

In July 2025, the Louisiana legislature enacted a new law establishing a regulatory framework for EWA, backed by strong bipartisan support. This law officially recognizes On-Demand Pay as a distinct financial product.

Conneticut

In June 2025, after months of negotiation, the Connecticut Legislature passed Senate Bill 1396, a measure exempting EWA services from Connecticut’s small loan law’s APR and finance charge requirements. SB 1396 was signed into law by Gov. Ned Lamont and will take effect on October 1, 2025, restoring access to On-Demand Pay for thousands of Connecticut employees.

1, 7 DailyPay Employee Experience Research, Arizent study commissioned by DailyPay, September 2023:DailyPay, 2020

2, 3, 6 Hanover Research Study: Companies with EWA Solutions, September 2023:DailyPay, 2020

4 Source:PwC

5 Source:CNBC

8 Source:Nevada State Legislature

9 Source:Missouri Senate

10 Source:Payments Dive

Get More On-Demand Pay Insights.

Thanks for subscribing!

You’ll start receiving On-Demand Pay resources soon.

Frequently Asked Questions

-

What is earned wage access?

Earned wage access is a financial wellness benefit that lets employees choose when they get their earned pay instead of the traditional pay cycle. Read more about what earned wage access is.

-

Is earned wage access the same as On-Demand Pay?

Yes, earned wage access and On-Demand Pay are different terms for the same benefit. Read more about what earned wage access is.

-

Which companies offer earned wage access? How does my company get earned wage access if we don’t currently have it?

Earned wage access through DailyPay is available to companies across the United States. Ask your payroll or human resources department if your company offers DailyPay.

-

How much does it cost to sign up for earned wage access?

There is no cost to your company when you sign up for DailyPay. Employees pay a small ATM-like fee of $3.49 for an immediate transfer or have a no-fee option for a transfer in one to three business days.

-

Is earned wage access the same as a payday loan?

No, earned wage access is a cost-effective alternative to predatory payday loans. Employees pay a small ATM-like fee for an immediate transfer or have a no-fee option for a transfer in one to three business days, which can save thousands of dollars and avoid damage to credit scores and financial health. Learn more about how DailyPay helps workers avoid the vicious cycle of predatory debt.

-

Why should a company offer earned wage access to their employees?

Earned wage access has various benefits for employers and employees. Increased retention, better productivity and greater financial wellness are a few of the notable benefits. Learn more about the benefits of earned wage access.

-

What is the difference between earned wage access and early wage access?

Some companies may offer “early wage access” which allows employees to get their direct deposit a day or two before the typical scheduled day.

-

What is “On-Demand Payroll” and is this the same as “earned wage access”?

“On-Demand Payroll” is often used as a synonym of EWA but it's a broader term. On-Demand Payroll can also include off-cycle payments and reward payment options.

-

Is “earned income access” the same as “earned wage access”?

Early income access is another term for earned wage access. It may also be referred to as On-Demand Pay.

-

Are there fees associated with earned wage access?

Yes, there are fees just like using an ATM, but we offer a no-fee EWA transfer option (1-3 business days). Learn more about no-fee EWA. -

What are earned wage access apps?

EWA providers feature apps where users can track their earnings, save money and make transfers to the account or card of their choosing. Learn more about the EWA app. -

What is earned wage access software?

While it is often referred to as software, EWA is a tool that can be integrated in existing softwares such as payroll. EWA “software” is an app where employees can make transfers of their earned wages and track spending.

Explore More about Earned Wage Access

See Why Top Companies Choose DailyPay

Empowering for Employees

Greater financial control with access up to 100% of their DailyPay balance to meet the challenges of unexpected financial disruptions.

Improved planning with visibility to spending and earned pay in one easy-to-use app.

No need for a pre-existing checking or savings account.

Simple and Secure for Employers

Minimal change to payroll processes — DailyPay handles it all.

Seamless integration with HCM, payroll, banking and benefit applications.

Enterprise-grade platform that keeps data private and the service running so it's always there when your employees need it.