The global pandemic has had devastating financial effects on so many. However, one positive effect that has resulted from the COVID-19 pandemic, according to a recent survey conducted by DailyPay and Funding Our Future, is that more American hourly workers are motivated to save money for the future. In fact, the survey determined that as they emerge from the global pandemic, 51% of those polled said they are more likely to save for the future as opposed to 15% who stated they were less likely to save.

Many Americans started out the pandemic with either negligible or no savings, making the financial insecurity they might have already been dealing with exponentially worse. So embarking on any type of personal saving initiative is a first for the 65% of respondents who said they don’t have any type of savings account and the 41% who stated they almost never put money away for the future.

Not only did the pandemic wreak havoc on people’s physical and mental health, job security and day-to-day living conditions, but it also had a significant impact on their financial situations. 40% of respondents said they are worse off since the pandemic shut down most of the American economy in March. In addition, 50% of those polled say they are either “finding it difficult to get by” or are “just getting by.” Another 40% report they are having difficulty paying bills each month.

For those who were lucky enough to have some savings, 57% had to dip into those savings due to the economic strains brought on by COVID-19. A renewed commitment to savings that was reflected in the survey might help to soften the financial blow when and if the next crisis comes our way.

Trying to save money during uncertain times can be difficult. Of those polled, 38% said that their primary means to save is keeping cash in their homes. But 62% said that they would save if there was an easier way to put money from their paycheck aside.

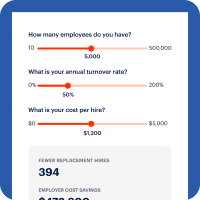

DailyPay’s Digital Wallet Solution incorporates a SAVE experience that allows employees to save money in three different ways, before payday. Employees can set aside the same amount each payday, a variable amount each payday or a designated amount when they use PAY to transfer part of their earned income.

With SAVE, employees benefit in multiple ways:

- Save it as they earn it. Employees have free access to save earned income before payday (when most money is already committed to expenses).

- Save with interest. If an employee has their own interest-bearing savings account, it’s compatible with DailyPay SAVE, and we facilitate deposits to that account.

- Free to Save. A recent DailyPay survey showed that 78% of employees would never pay for an app to help them save. With DailyPay, there’s zero cost to save.

- Financial wellness tips as they go. We offer practical and motivating financial tips to help employees begin to save and then stick with it.

The fact that the pandemic has made so many people realize that they need to begin a savings program is a good thing. Having some money to lean on when a crisis or any emergency hits will bring about a measure of financial stability that was previously lacking. And financial stability and wellness has proven to ease anxiety as we all look forward to a brighter future.

You can find more complete information about this survey here.