You have lots of things to think about and take care of, so it’s easy to let things like contributing to your savings account slip through the cracks. It’s even easy to forget to pay a bill on time, especially if many of your bills have different due dates.

Fortunately, many companies and banks have automatic payments and savings features available. Automatic payments allow you to set up bill payments through your bank account or debit card ahead of time, so you don’t have to think about when your bills are due. Once you set up this feature, money will automatically be deducted from your account to pay the bill. Some companies, including many banks, even allow you to stagger your payments throughout the month if too many bills are due on the same day.

When considering setting up automatic payments, think about which bills seem to sneak up on you every month. Maybe that’s your cable bill or EZ Pass bill. These are the ones that you should set up automatic payments for, so they don’t slip through the cracks. However, to ensure your bank account’s safety, you should set up alerts on your bank account to let you know when payments are made.

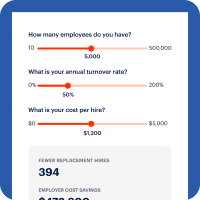

Sometimes even with automatic payments, bills sneak up on you when you aren’t ready. However, with PAY by DailyPay, you can use your earned pay to pay these bills in between paydays, so you don’t have to worry about overdraft fees, late fees or payday loans.

Another thing to consider is automatic savings. Sometimes it can be difficult to think about saving when there are so many things to pay for right now, but saving a little bit at a time can be easy and helpful in the long run. Since savings accounts accrue interest (good interest, not to be confused with interest like you pay on loans), your money will grow over time. So it’s important to continuously add to your savings accounts, even if it’s a little bit at a time.

DailyPay helps you to save automatically at no cost to you. If your employer offers DailyPay as a benefit, you can transfer your Pay Balance to a savings account seamlessly, making it easy to save without even thinking about it.

Looking for more financial wellness tips? Check out some of our other financial wellness resources.