Education Series Module 7: Foster Diversity, Equity, and Inclusion with On-Demand Pay

Foster Diversity, Equity, and Inclusion with On-Demand Pay

Explore how on-demand pay can support your company’s DE&I efforts.

Ready to get started with on-demand pay?

At a Glance

Diversity, equity, and inclusion are at the forefront of many leaders’ minds as they strive to create work environments where everyone feels welcome. However, financial equity and inclusion are not always discussed as frequently, although they’re an important aspect.

- On-demand pay can support your company’s improvement of diversity, equity, and inclusion.

- Financial equity and inclusion is an often overlooked facet of diversity, equity and inclusion.

- Employers should focus on financial equity and inclusion to help improve employee well-being.

- On-demand pay can play a crucial role in improving employee well-being, financial equity, and inclusion.

Economic Inequality Isn’t Going Away

At its most basic level, financial equity and inclusion mean ensuring that individuals have equal access to professional opportunities, financial systems, products, and services that can potentially lead to wealth generation. Wealth gaps between people of different races, genders, and abilities create financial inequity.

1.7B

adults are unbanked or underbanked.1

of working Americans are living paycheck to paycheck2

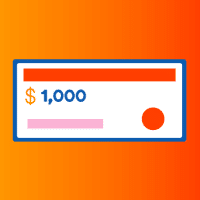

Only 4 in 10 adults could cover $1,000 worth of emergency expenses.2

18%

On average, women are earning 18% less than men for doing the same job.3

For every $1 a man earns, a woman earns $0.82. Broken down by race, Asian-American women earn $0.90, Black women earn $0.61, Native American women earn $0.57, and Latina women earn $0.54.4

Gay men earn 7.4% less than heterosexuals, while bisexual men earn 9.7% less, and bisexual women earn 4.7% less.5

In 2020, the median household income for White families in the U.S. was $74,912, while the median household income for Black families was $45,870, and for Hispanic families, it was $55,321.6

In 2021, the average credit card balance for White families was $6,940. For Black families, it was $3,940, and for Hispanic/Latino families, it was $5,510.7

Powering Financial Equity and Inclusion

Unlike traditional financial wellness tools, on-demand pay offers clear financial inclusion benefits. On-demand pay empowers employees with more choices and opportunities so they can avoid fees by giving them access to their money as they earn it.

By providing employees with access to on-demand pay, employers are offering a valuable option for their employees who may not have bank accounts or banking relationships, or who may simply be restricted by traditional payment schedules.

Unbanked or underbanked individuals may lack access to many traditional resources that financial institutions provide, and on-demand pay can help them save money by avoiding fees from loans, overdraft fees, and late fees.

Supporting Employee Financial Well-Being

Access to on-demand pay helps users to:

- Improve their credit scores because they have better access to their funds to pay bills on time.

- Build their savings by diverting money wasted on late fees, overdraft fees, and credit card interest to their savings.

- Become more financially independent because they don’t have to rely on payday loans or pay advances.

Why Employers Should Care

Today’s employees want to work for a company that cares for their holistic well-being, especially where finances are concerned.

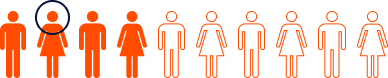

4x

Employees whose financial stress has increased due to the pandemic are nearly four times as likely to admit that their finances are a distraction at work.

Additionally, they’re more likely to be attracted to another company that cares more about their financial well-being.8

Employers who care more about their employees can help strengthen the employee-employer bond, creating a more mutually beneficial relationship. Specific benefits can come from supporting financial equity and inclusion, such as:

Inclusion boosts engagement and retention

Employees who feel included in their organizations are 3x more likely than their peers to feel excited by and committed to their organizations.9 This feeling of contentment has the potential to decrease voluntary turnover and increase retention.

Diverse ideas produce better outcomes

Diversity of thought within an organization is one of the surest ways to promote innovation and gain a competitive advantage.

75%

of organizations with decision-making teams reflecting a diverse and inclusive culture will exceed their financial targets through 2022.10

Financial Inclusion Can Lead to a More Equitable Society

Sample RFP Questions

When considering partnering with an on-demand pay provider, it’s critical to holistically evaluate each solution you’re considering in order to make the most educated selection. Thoroughly assessing the product experience for employees and employers, as well as security, privacy, and compliance for each solution will help you choose the best solution for your company.

Questions to consider asking based on the teachings in this module are:

- How does this technology support financial inclusion?

- Does this solution include financial wellness tips to strengthen users’ financial literacy?

Receive the Sample On-Demand Pay RFP

Thank You for Submission

Thank you.

We will get back to you soon to schedule your demo.

Thank you for your interest in the On-Demand Pay International Council!

We will get back to you in 2-3 business days.

Infographic

On-Demand Pay: The Benefits and Potential Pitfalls