Financial Wellness Series The Impact of Financial Wellness Programs

Module 3

The Impact of Financial Wellness Programs

Financial wellness programs have grown in popularity as a vital benefit for organizations to consider for their employees. These programs not only benefit employees by improving their financial wellness but they can also lead to significant advantages for employers.

Financial wellness programs contain various initiatives to help improve employee financial wellness and reduce their financial stress. Financial wellness programs can include educational workshops, one-on-one financial coaching and access to financial tools and resources.

As we’ve highlighted in our recent financial wellness education modules, financial wellness should be a key focus for your company. Whether you want to improve employee engagement or reduce employee turnover, financial wellness can be the key.

Companies that increase their focus on employee wellness can improve engagement, employee retention and productivity across your workforce.

Why Your Company Should Consider A Financial Wellness Program

As discussed in the previous financial wellness education module, financial wellness programs educate employees on managing their finances.

Your company should consider a financial wellness program because it directly contributes to employee satisfaction, retention, and productivity. Financial stress can significantly impact mental health and work performance, leading to increased absenteeism and decreased productivity. By offering a financial wellness program, you provide employees with tools and resources to manage their finances effectively, reducing stress and enhancing their overall well-being. This support can foster a more engaged, loyal, and productive workforce, while also positioning your company as a caring and desirable employer. Ultimately, investing in financial wellness is an investment in the health and success of both your employees and your business.

These comprehensive programs empower employees and support their financial wellness through education, resources and support.

The Benefits of a Financial Wellness Program

There are a plethora of benefits of a financial wellness program that should convince you of the importance of adopting these for your organization. Let’s take a look at some of the meaningful difference-makers for both employees and employers.

Financial Wellness Program Benefits for Employees

Financial wellness reduces stress, and improves job satisfaction and a sense of security. It provides the means to achieve personal goals, whether that’s homeownership, education or retirement planning.

Reduced Financial Stress

Nearly all Millennial hourly workers (94%) find managing their finances stressful, with 75% saying the stress has a negative impact on their mental or physical health.1 This increased financial stress can make it difficult for employees to focus on their jobs.

Luckily, there’s a solution to combat this stress in financial wellness programs backed by earned wage access (EWA).

60%

of DailyPay users surveyed say that DailyPay helps reduce their financial stress.2

Financial Wellness Program Benefits for Employers

Employee financial wellness programs can help your employees learn to control their finances.

Improve Retention and Recruitment Efforts

According to a Bank of America study, financial wellness is proven to increase retention and attract higher-quality employees while raising employee satisfaction.3 When implemented correctly, it’s possible for financial wellness programs to better a workplace.

The aforementioned Bank of America survey shows that plan sponsors believe utilizing financial wellness programs makes good business sense.

Increase Productivity and Morale

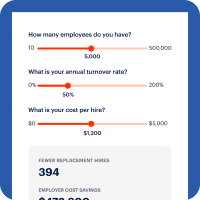

Financially secure employees are better equipped to focus on their tasks, leading to increased productivity and reduced absenteeism. Increased financial wellness can also improve retention rates, reducing recruitment and training costs.

Additionally, employers who offer financial wellness programs are seeing noticeable improvements in productivity (50%), reducing employee stress (43%), employee morale (41%) and employee creativity and innovation (36%).4

Why Your Company Should Start Improving Financial Wellness Today

As we’ve seen, the impacts are real. Implementing a financial wellness program is more than just a perk for your employees to get better access to their earned pay through EWA. Financial wellness programs can be a strategic investment for both your employees’ wellbeing and the success of your organization.

As your organization continues to stand out from the competition and prioritize employee wellness, financial wellness programs will be a key aspect.

1 Harris Poll survey commissioned by Funding our Future and DailyPay, July 2023:DailyPay, 2020

2 DailyPay User Survey, August 2023:DailyPay, 2020

3, 4 Source:Bank of America Study, 2022

Module 2

Employee Financial Wellness Programs

See Why Top Companies Choose DailyPay

Empowering for Employees

Greater financial control with access up to 100% of their DailyPay balance to meet the challenges of unexpected financial disruptions.

Improved planning with visibility to spending and earned pay in one easy-to-use app.

No need for a pre-existing checking or savings account.

Simple and Secure for Employers

Minimal change to payroll processes — DailyPay handles it all.

Seamless integration with HCM, payroll, banking and benefit applications.

Enterprise-grade platform that keeps data private and the service running so it's always there when your employees need it.

DailyPay is Trusted by Leading Companies