Financial Wellness Series Employee Financial Wellness Programs

Module 2

Employee Financial Wellness Programs

Financial wellness should be a key focus for your company. Whether you want to improve employee engagement or reduce employee turnover, financial wellness can be the key.

Companies that increase their focus on employee wellness can improve engagement, employee retention and productivity across your workforce. While benefits like earned wage access (EWA) can go a long way toward improving employee financial wellness, there are also financial wellness programs and platforms that can take this approach a step further.

What Are Financial Wellness Programs?

Financial wellness programs educate employees on how to manage their finances. These comprehensive programs are designed to empower employees and support their financial wellness through education, resources and support.

These programs can address various aspects of personal finance, including budgeting, saving, investing, debt management and retirement planning.

By fostering financial literacy and offering practical tools, these programs aim to empower individuals to achieve their short and long-term financial goals, reduce financial stress, and build a solid foundation for a secure and prosperous future.

Whether delivered through workshops, online resources or counseling, financial wellness programs strive to equip individuals with the knowledge and skills necessary to navigate their finances and make better decisions for the future.

Education Through Financial Wellness Programs

In addition to the education aspect of financial wellness programs, the other side of the coin is an employee’s overall financial health and knowledge. This usually focuses on employees following some best practices and having support from their employer to reduce money-related stressors.

Let’s take a look at a few financial wellness programs that are available to employees across the United States at no cost.

Financial Literacy and Education Commission

The Financial Literacy and Education Commission was established under the Fair and Accurate Credit Transactions Act of 2003.

The Commission is intended to help all Americans build toward sustained financial wellness. They accomplish this by setting strategic direction for policy, education, practice, research, and coordination so that all Americans make informed financial decisions.

Learn more about the Financial Literacy and Education Commission.

Consumer Financial Protection Bureau

Many responsible employers are taking note of how volatile financial markets have impacted their employees including decreased productivity, increased absenteeism and declining overall health. These employers have taken action to support employees, compiled in the CFPB report.

Learn more about the research from the CFPB.

National Association of State Treasurers

According to the National Association of State Treasurers, wages have not been keeping pace with the cost of living. To address this disparity, the Association has tailored education and support programs to help government employees address this.

Learn more about the National Association of State Treasurers.

How Employers Can Support Financial Wellness Programs

Although financial wellness benefits and programs are directly focused on employees, it’s clear that employees are not the only ones who will reap the rewards. As mentioned earlier, the benefits will ripple through to employers with the overall increase in engagement and retention, turning dividends for employers.

Therefore, it’s beneficial for employers to determine how they can support their employees with these programs. Whether your company already has a financial wellness program that you are looking to build on, or you’re starting from scratch, there are resources to help you.

The CFPB has compiled free and objective resources across all things financial wellness to get you started.

In the next education module (coming soon), we’ll dive more into the benefits of employee financial wellness programs and why all employers truly should consider this support and empower their employees.

thought leadership

A Guide to Employee Financial Wellness

thought leadership

Reduce Turnover With an Employee Retention Strategy

See Why Top Companies Choose DailyPay

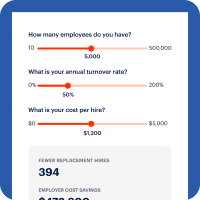

Empowering for Employees

Greater financial control with access up to 100% of their DailyPay balance to meet the challenges of unexpected financial disruptions.

Improved planning with visibility to spending and earned pay in one easy-to-use app.

No need for a pre-existing checking or savings account.

Simple and Secure for Employers

Minimal change to payroll processes — DailyPay handles it all.

Seamless integration with HCM, payroll, banking and benefit applications.

Enterprise-grade platform that keeps data private and the service running so it's always there when your employees need it.

DailyPay is Trusted by Leading Companies