Empower Employees With DailyPay

Support employee financial wellness Accelerate recruiting. Increase retention.

of users say DailyPay has helped them reduce financial stress. 1

of users say they are more motivated to remain with their current employer because they offer DailyPay. 2

increase in tenure of employees who used DailyPay over non-DailyPay users. 3

1, 2 DailyPay User Survey, November 2022; 3 EWA Report, Mercator Advisory Group commissioned by DailyPay, March 2021

Elevate Employee Financial Wellness

Choice and control of earned pay improves financial well-being, which results in improved employee engagement, motivation and tenure.

Track

Instantly see earnings for shifts, tips and paychecks.

Transfer

Access earned pay when needed.

Save

Two ways to save to easily make it a habit.

Transparent Pricing for Your Employees

With DailyPay, employees get multiple ways to access their earned pay, multiple ways to save and multiple ways to learn.

or less

(flat fee)1

1 Fees vary by employer

Frequently asked questions

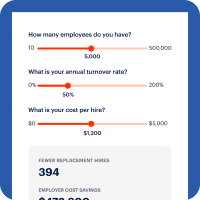

No change to your payroll

There’s no change to processes or extra work for your payroll teams.

Seamless integration

It’s already done — merely sign up to provide employees with enhanced financial wellness.

DailyPay funds all transfers

This means there will be no impact to your cashflow.

DailyPay was the fastest implementation to any benefit we have ever done.

Katie Johnson

CFO | SEJ Services