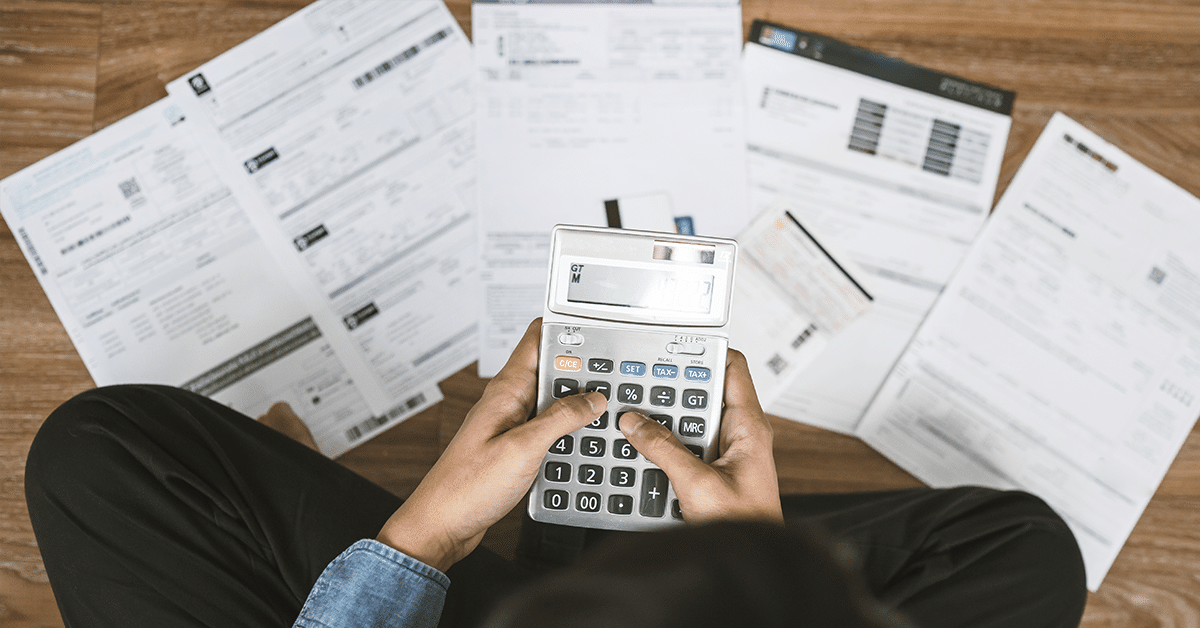

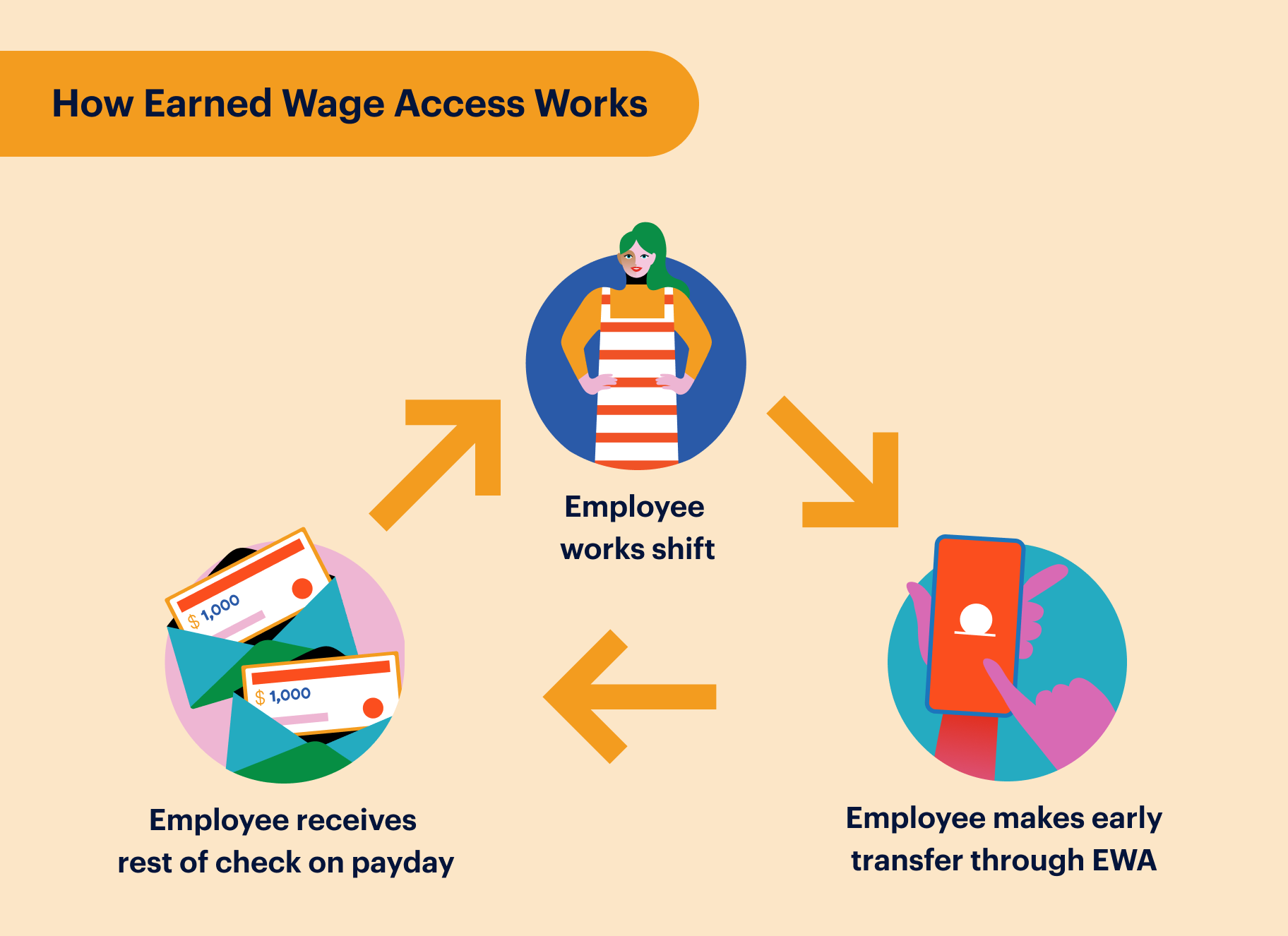

Employee Financial Wellness: Why Employers Should Make It Their Top Priority

Employee financial wellness is a concept that Payroll and HR leaders are becoming increasingly concerned with. While this was once a more distant idea that employers weren’t so personally invested in, the pandemic has brought to light how much companies