Gen Z Hourly Workers Say Employers Should Help Manage Financial Stress

Gen Z (ages 18-26) is struggling to manage their finances and pay bills on time, and it’s having a negative effect on their health.

Check out the new data from the Harris Poll, commissioned by Funding Our Future and DailyPay, that illustrates the challenges these newest members of the workforce are facing.

If you’re looking for innovative ways to help employees reduce financial stress, download our financial wellness eBook to see how leading companies are using DailyPay to empower their workforce and become the employer of choice in their industry.

The Economic Impact on Gen Z Hourly Workers

50%

of Gen Z hourly workers say they would benefit from getting paid more frequently at work than they currently do.

32%

of Gen Z hourly workers would consider leaving their current employer for a new one that allows them to access their pay, as they earn it.

79%

of Gen Z hourly workers say they don’t always have enough money to pay a bill on time. In comparison, 76% of millennials and 61% of Gen Xers say the same.

85%

of Gen Z hourly workers say inflation has negatively impacted on their finances in the past year.

96%

of Gen Z hourly workers find managing their finances stressful. This compares to their older colleagues in the workforce who are also finding managing their finances stressful: 94% of millennials and 91% of Gen X.

75%

of Gen Z hourly workers say the stress has a negative impact on their health (mental, physical or both).

43%

of Gen Z hourly workers are saving less than they were a year ago.

86%

of Gen Z hourly workers believe the economy will stay the same or decline in the next year.

20%

of Gen Z hourly workers report using an on-demand pay app compared to only 8% of Millennials and 6% of Gen X hourly workers.

How to Help Gen Z Manage Their Finances and Stress Levels

Being that financial management and stress go hand-in-hand for Gen Z hourly workers, companies have a responsibility to help them manage both. One way they can do this is through innovative pay strategies that prioritize employee financial wellness. Companies that create employee-first cultures to help relieve stress regularly outpace the competition.

Download this free eBook to learn how companies use DailyPay to empower their employees and lead their industries.

Thank You for Submission

Thank you.

We will get back to you soon to schedule your demo.

Thank you for your interest in the On-Demand Pay International Council!

We will get back to you in 2-3 business days.

Survey Methodology

This survey was conducted online within the United States by The Harris Poll on behalf of DailyPay from June 28-30, 2023 among 707 U.S. hourly workers 18 and older.

The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the sample data is accurate to within +/- 4.3 percentage points using a 95% confidence level.

For complete survey methodology, including weighting variables and subgroup sample sizes, please contact david.schwarz@dailypay.com.

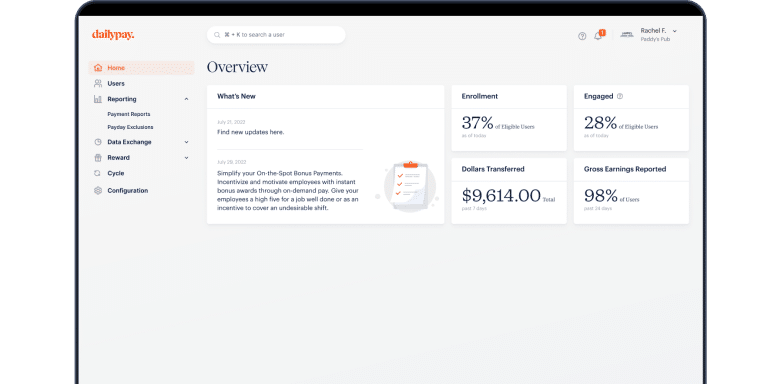

The DailyPay Solution

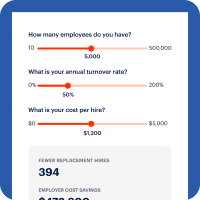

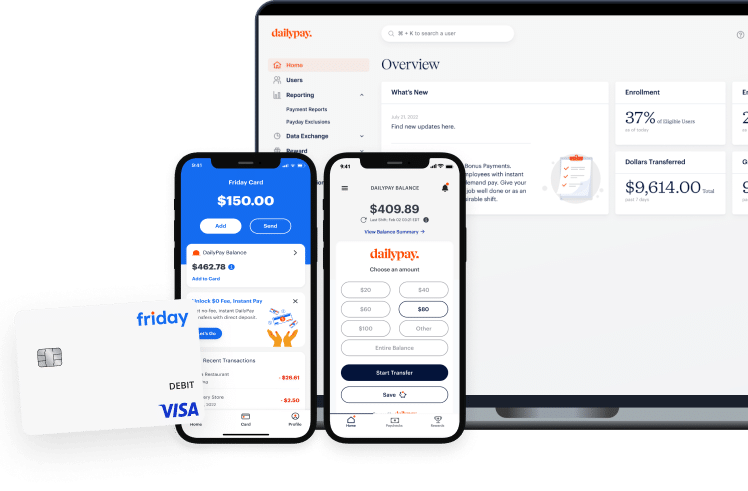

DailyPay helps you deliver on-demand pay that gives your employees the financial control they need to be more engaged, motivated and happier at work. Increased employee loyalty reduces business costs and increases productivity.

Explore how the DailyPay Solution can help build financial wellness.

See Why Top Companies Choose DailyPay

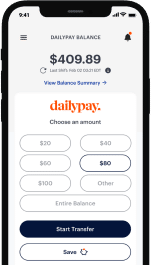

Empowering for Employees

Greater financial control with access to 100% of their DailyPay balance to meet the challenges of unexpected financial disruptions.

Improve planning with visibility to spending and earned pay in one easy-to-use app.

No need for a pre-existing checking or savings account.

Simple and Secure for Employers

Minimal change to payroll processes — DailyPay handles it all.

Seamless integration with HCM, payroll, banking and benefit applications.

Enterprise-grade platform that keeps data private and the service running so it's always there when your employees need it.