Financial Wellness Series Employee Financial Wellness – Why It Matters

Module 1

Employee Financial Wellness – Why It Matters

A company’s most important investment is its workforce, so the financial wellness of employees directly affects its bottom line.

When employees are financially secure, they experience reduced stress and distractions related to personal finances, leading to improved focus and productivity at work.

This enhances the overall work quality and efficiency. Additionally, financially stable employees are less likely to seek alternative employment opportunities, reducing turnover and the associated costs of recruitment and training.

Furthermore, financially well employees tend to make better healthcare choices, resulting in lower health insurance costs for the company. They are also more likely to participate in retirement savings plans, reducing the burden on the company’s pension obligations. In essence, prioritizing employee financial wellness can lead to a more engaged, committed and ultimately, a more profitable workforce.

73%

According to a CNBC poll, 73% of Americans rank finances as the No.1 stress in life.1

According to research published by Zippia

- More than 50% of workers are not engaged at work because of stress.2

- 1 million employees miss work every day because of stress.2

- 83% of US workers suffer from work-related stress, with 25% saying their job is the number one stressor in their lives.2

- Depression-induced absenteeism costs US businesses $51 billion a year, as well as an additional $26 billion in treatment costs.2

Having control over finances and being able to make different choices is vital to employee well-being, motivation, productivity and loyalty.

How to Improve Employee Financial Wellness

Although employers can’t completely eradicate stress from their employees’ lives, they can help alleviate financial stress and improve employee financial wellness.

Employers can offer financial wellness benefits that encourage employees to keep track of earnings and expenses, pay bills on time, save, budget for the future, gain financial knowledge and more.

These may include financial education and counseling programs to improve money management skills and reduce debt.

Employer-sponsored retirement plans, like 401(k)s, can help employees save for the future, while contributions or matches from the company provide added incentives.

Flexible spending accounts and health savings accounts enable employees to plan for healthcare expenses efficiently. On-demand pay allows workers to access earned wages when needed, reducing the need for high-interest payday loans or credit card debt. Additionally, access to budgeting tools and resources, or even short-term emergency funds, can assist in navigating unexpected financial challenges. These benefits not only reduce stress but also boost overall financial well-being, enhancing employee focus and productivity.

Good financial wellness is essential to achieving financial well-being.

Employee Financial Wellness Solutions

Everybody’s financial situation is different, so traditional programs like 401(k)s don’t benefit everyone equally. Offering customizable benefits is the most effective and fair way to improve financial wellness for all employees. Financial wellness benefits that are personalized and different for each employee are the most useful in today’s rapidly changing society. Here are some personalized financial wellness benefits employees like.

Full Earnings Transparency

With work notions changing over the past few years, more and more employees are feeling empowered to take more control over their earnings, and one way to do that is by having full transparency into earnings.

It is important for employees to know how much money they earn in order to achieve financial well-being. Despite what seems obvious, most employees don’t know how much money they’ve earned until they receive their paycheck, and in order to calculate exactly how much money they earned per day or per shift, they have to divide the total by the number of hours they worked and take into account taxes, withholdings and more. By giving employees a simple way to track their earnings per shift, you can build trust and help employees feel more confident about their finances.

On-Demand Pay

A salary raise can’t solve everyone’s financial problems, but it is possible to pay them frequently enough to solve some.

On-demand pay — also known as earned wage access — allows employees to get their earned pay whenever they want, without having to wait for payday. The best on-demand pay providers allow employees to access their earnings without making them pay a fee.

With reports of as many as 60% of Americans living paycheck to paycheck, on-demand pay is one of the best employee financial wellness benefits available today.

Real-Time Rewards

When employees are instantly recognized for their work, it’s easier for them to associate winning work behavior with a reward, motivating them to be more productive.

The option of adding a bonus to your employee’s next paycheck, or even giving him or her a gift card, both have pros and cons. The most effective employee recognition tools allow employers to instantly give employees digital cash rewards without having to do any extra work regarding taxes or payroll. You can even find tools that allow you to empower regional managers to reward local teams with full autonomy.

Savings Tools

According to a Harris Poll Consumer Finances study commissioned by DailyPay and Funding Our Future:

87%

of employed Americans say it is at least somewhat important that their employer offers a retirement savings program, such as a 401(k) account.4

Americans think it’s important to save money, and they expect their employers to help them do so. This means offering traditional programs like 401(k)’s and IRA accounts, but also offering simple, no-frills ways to save. Not every employee has the resources needed to learn how to most effectively fund a 401(k), Roth IRA, HSA or any of the other traditional savings tools usually available to employees, but every employee understands the concept of setting aside 10% from each paycheck for a rainy-day fund. They just need simple tools that allow them to save, like DailyPay’s multiple savings features that allow employees to set aside cash in just a tap.

How Employers Can Help With Employee Financial Wellness

Employee financial wellness is an employee’s ability to effectively manage their finances. That means being financially prepared for emergencies, spending within their means, planning for the future and having access to the tools and information needed to make good financial decisions.

A company’s most important investment is its workforce, so the financial wellness of employees directly affects its bottom line. Employees who have control over their finances are happy, healthy, motivated, productive and loyal.

Employers have the power and the responsibility to help employees improve their financial wellness. The most effective way to do so is to first ask your employees what they need help with financially, and then offer a mix of traditional and modern financial wellness benefits that will reach all employees at your company. To best support your employees, customizable and personal financial wellness benefits are essential. Cookie cutter programs won’t reach every employee and there’s no one-size-fits-all when it comes to personal financial wellness.

What Are the Benefits of Improved Employee Financial Wellness?

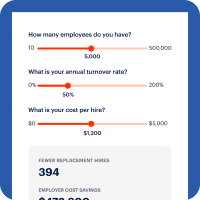

DailyPay was created to help employers offer modern financial wellness benefits to their employees and help employees improve their financial wellness. We’ve done the research, and here are the effects of helping employees improve their financial wellness with DailyPay.

67%

of users say DailyPay has helped them reduce financial stress5

- 49% of users say DailyPay helps them avoid late fees or overdraft fees6

- 48% of users say DailyPay helps them plan for the future and pay their regular bills on time7

- 30% of users say DailyPay helps them gain better control of their finances8

- 52% of users say their opinion of their employer has improved since they began using DailyPay9

- 77% of users surveyed by Mercator Advisory Group said that DailyPay’s on-demand pay benefit helps them save money by avoiding other more expensive alternatives to handle expenses10

- 90% of users surveyed by Mercator Advisory Group reported improvement or elimination of reliance on legacy financial alternatives like overdraft fees, payday loans and late fees11

1 Source:CNBC, June 2023

2 Source:Zippia, February 2023

3 Source:CNBC, October 2022

4 Harris Poll Consumer Finances study commissioned by DailyPay and Funding Our Future, December 2021:DailyPay, 2020

5, 6, 7, 8, 9 DailyPay User Survey, November 2022:DailyPay, 2020

10, 11 Customer Perceived Savings Report, Mercator Advisory Group commissioned by DailyPay, August 2022:DailyPay, 2020

thought leadership

Reduce Turnover With an Employee Retention Strategy

education series

All You Need to Know About On-Demand Pay

thought leadership

How Can an Earned Wage Access Platform Help Your Business?

See Why Top Companies Choose DailyPay

Empowering for Employees

Greater financial control with access up to 100% of their DailyPay balance to meet the challenges of unexpected financial disruptions.

Improved planning with visibility to spending and earned pay in one easy-to-use app.

No need for a pre-existing checking or savings account.

Simple and Secure for Employers

Minimal change to payroll processes — DailyPay handles it all.

Seamless integration with HCM, payroll, banking and benefit applications.

Enterprise-grade platform that keeps data private and the service running so it's always there when your employees need it.

DailyPay is Trusted by Leading Companies