Pay Balance:

The Next New Money Balance

For years, employees have looked at their checking, savings and 401(k) account balances (if they had them) to determine how much money they had and to appraise their net worth. But what’s been missing is an essential component of that net worth — the employee’s Pay Balance.

So, What Exactly is the Pay Balance?

An employee’s Pay Balance is the amount of money she has made in the current pay cycle, which has not yet been received by the employee in a paycheck or through direct deposit.

At DailyPay, we see a future where employees can use their Pay Balance like they would use any other account balance. Their Pay Balance is an essential part of their net worth.

At DailyPay, we see a future where employees can use their Pay Balance like they would use any other account balance. Their Pay Balance is an essential part of their net worth.

Would an Example Help?

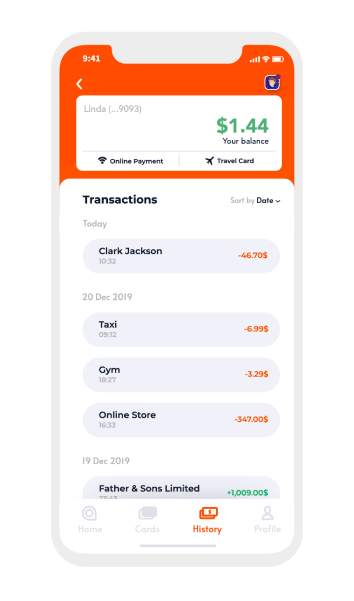

Consider the following situation:

Unfortunately, this situation is far too familiar for many working Americans. Nearly 1 in 3 Americans runs out of money before payday, across all income levels. If the employee with this checking account balance had a bill to pay, she would most likely have to pay the bill late, incurring a late fee, or she’d have to overdraft her account, or worst case scenario — she’d be forced to borrow from a payday lender.

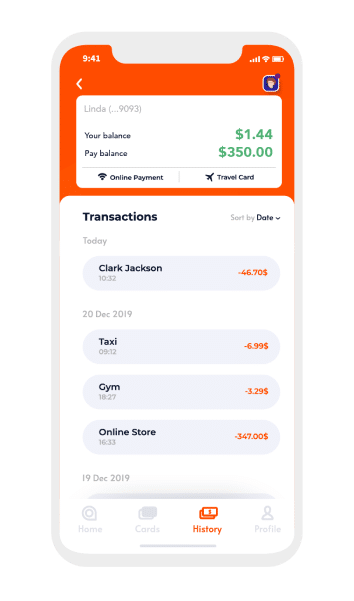

Now, let’s consider the bank account of the near future that includes the employee’s Pay Balance:

The Pay Balance in this example isn’t a loan – it’s the employee’s money —money that she has already earned. In this sense, it is just like any other account balance. And in fact, in this example, this balance is the difference between this person paying a bill or incurring some form of additional debt.

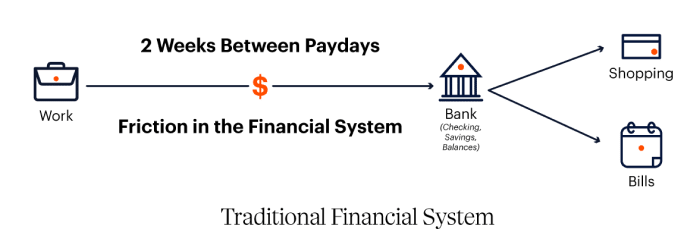

The Current Financial

System Creates Friction

When employees earn wages each day but have to wait for a scheduled payday, there is friction.

Employees suffer

This delay causes all kinds of complications and stress — from difficulty paying bills to expensive forms of short-term borrowing, like overdrafts or small-dollar loans.

Merchants and billers suffer

Late fees and overdrafts that employees incur due to the time lapse between when they earn their wages and when they actually receive them represents lost revenue for them. This is money that could be going to the purchase of goods and services, powering local businesses and commerce.

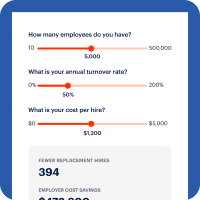

Employers suffer

The friction caused by the current financial system leaves employees stressed out about their personal finances, so they are less engaged and more likely to be dissatisfied with their jobs.

Financial services providers suffer

The financial system causes friction for them as well because consumers who incur repeated fees logically have an unfavorable view of the financial institutions they use.

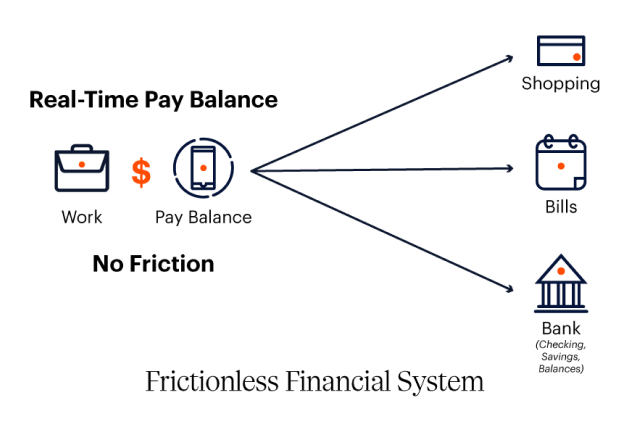

The Pay Balance Eliminates All This Friction

Our mission at DailyPay is to leverage our technology to rewrite the invisible rules of money. By leveraging a real-time Pay Balance, we create value for all stakeholders in the financial system.

So Where Do We Go From Here?

Over the past six years, we have partnered with leading employers, including Target, Dollar Tree, Kroger, Six Flags and HCA, to ensure that their employees have a complete and accurate picture of their real-time financial profile through their Pay Balance.

But we envision a time in the not-too-distant future when employees can use their Pay Balance to buy food, to pay a bill or to pay for gas, giving them access to their money — in the right place and at the right time.

We see a world where they can transfer to any account directly from their Pay Balance. They can do anything with their Pay Balance that they do now with the money in their checking account.

This is how the world should work. A simple, continuous movement of money from the minute an employee earns it.

Join our mission.