Retail

Happy Employees Make Happy Customers

Reduce turnover, decrease absenteeism, and improve timeclock compliance with On-Demand Pay, also known as earned wage access for retail.

Trusted by leading Companies

New Research: The State of Retail Workers' Finances

benefits for retailers

How Can On-Demand Pay Help the Retail Industry?

When employees aren’t stressed over their finances, they bring their best selves to work.

1 Retail Workers Research commissioned by Talker, June 2025:DailyPay, 2020

2, 3, 6 DailyPay Employer Experience Research, Arizent study commissioned by DailyPay, September 2023:DailyPay, 2020

4 Hanover Research Study: Companies with EWA Solutions, September 2023:DailyPay, 2020

5 McKinsey & Company, “How Retailers Can Build and Retain a Strong Frontline Workforce in 2024”, July 17, 2024:DailyPay, 2020

turnover calculator

What Results Can Your Company Expect From DailyPay?

This employee retention tool lets you adjust your number of employees, turnover rate, and cost per new hire to calculate your estimated employee retention savings and see if you can reduce retail turnover by implementing DailyPay.

How many employees do you have?

What is your annual turnover rate?

Cost per new hire

fewer replacement hires

0

employer cost savings

0

Disclaimer: Calculations based on assumptions and annualized averages

Here’s What Leading Retailers Say About DailyPay

“If you’re truly invested in giving employees the best experience at the company you work for, why would you not want a completely hands off benefit with a seamless integration? The results speak for themselves, to me it’s a no-brainer.”

Tiffany Paquette

Director of People Technology & Operations, Puma

Puma experienced a 50% reduction in timecard reconciliations after implementing DailyPay.

“Our business and the industry, in general, has high turnover because we have a lot of part-time and seasonal employees, so we believe having DailyPay is a valuable benefit that helps keep them around a bit longer and attract new talent.”

Sarah Anderson

Accounting Manager & Head of Payroll, Pet Paradise

Lisa Voytko

Director of HR Operations, Pet Paradise

45% are more motivated to remain with Pet Paradise because they offer DailyPay.

“Our new hire base who used DailyPay would stay with us twice as long as those who didn’t use it. The early results were really compelling. All stats and data show employees are using it responsibly and for the right reasons.”

Abby Ludens

Chief Talent Officer, Comoto Holdings

Top 3 reasons for transfers reported by Comoto holdings: 32% for bills, 18% for transit, 15% for food.

“Our main reasons for seeking an On-Demand Pay benefit were to help increase retention and decrease turnover with all its associated costs… Our employees that have chosen to take advantage of this benefit have been very happy, so we are happy.”

Taylor Leevers

Special Project Manager, Leevers Supermarket

Nearly half (49%) of users say DailyPay makes them feel more motivated at work.

How DailyPay Works

A seamless process for providing early access to earned pay.

1

Employees complete a work shift.

2

DailyPay calculates employees’ shift earnings and makes a portion of their earned pay available to them.

3

Employees can access earnings instantly for $3.49.#

# Fees vary by employer

4

Any earnings that aren’t accessed early are automatically paid on payday like normal.

Features For Employees and Employers

Leading retailers understand that happy employees lead to happy customers.

Empower Your Employees

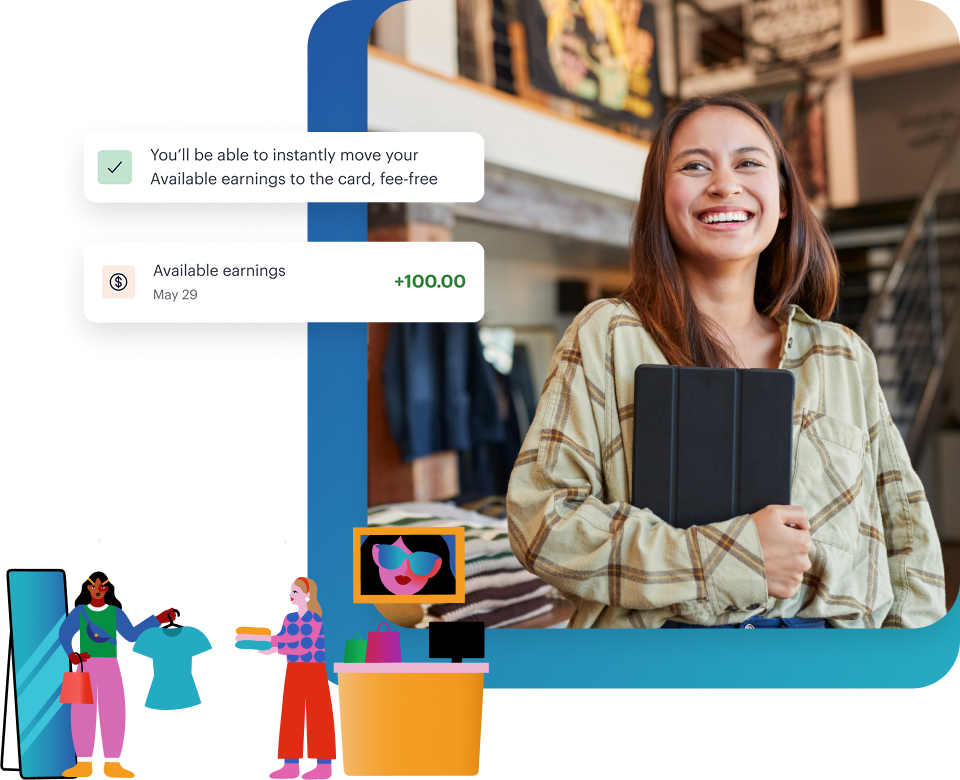

On-Demand Pay

Track earnings per shift and access earned pay within 1-3 business days for no fee or instantly** for a flat, ATM-like fee.

Anytime access to earned pay.

DailyPay Prepaid Visa® Card

Unlock more than just instant, no-fee access to earned pay. Enjoy cash-back¶ rewards and Savings jars.

Instant, no-fee* access to earned pay.

Credit Health

Track progress, protect from fraud, and prepare for the future with no negative impact to credit score.

Monthly free credit checks and credit monitoring.

Enhance Your Business

Cycle

A paperless and cost-effective way to disburse same-day termination pay and payroll corrections to any employee account.

Digitally send off-cycle pay to any employee, whether or not they use DailyPay.

Portal

Your central hub for program management plus access to the Success Hub, where you can find all resources needed for success.

Track program performance and usage to easily manage, measure, and optimize.

Reward

An impactful, customizable, scalable, and measurable solution for creating targeted recognition programs. Send same-day cash and motivate employees.

Reward employees in the moments that matter with real-time, digital bonuses.

DailyPay Integrates With Payroll and Attendance Systems

Partnering with DailyPay requires no additional work to implement and administer an On-Demand Pay program. Integrations are seamless and painless.

Retail Payroll Integration Simplified With DailyPay

DailyPay integrates with retail payroll systems like ADP and Workday, and 180+ HCM, payroll, and time management systems to deliver its industry-leading On-Demand Pay platform to millions of users. Partnering with DailyPay does not add an extra burden for your team. We take pride in handling the hard work of getting DailyPay up and running for you.

Resources for Retailers

You Asked, We Answered.

-

How can DailyPay help companies in the retail industry?

DailyPay may help retailers improve turnover and retention rates by offering a benefit that improves employee wellness and engagement. Learn more about how DailyPay can improve employee retention.

-

How does DailyPay work with employees that don’t have a bank account?

Employees who don’t use a bank account can sign up for the DailyPay Visa Prepaid Card. No preexisting bank account is needed to get early access to earned pay using the DailyPay Card, which also unlocks instant, no-fee* access to earnings.

-

Can seasonal staff and part time staff use DailyPay?

Yes. Seasonal and part-time employees can use DailyPay and continue using the DailyPay Card and its benefits when they leave their job or start a new job at a company that doesn’t offer DailyPay.

Elevate Your Retail Business With the Future of Employee Pay

Schedule your personalized demo today.

Thank You for Submission

Thank you for your submission. One of our representatives will contact you soon.

Thank you.

We will get back to you soon to schedule your demo.

Thank you for your interest in the On-Demand Pay International Council!

We will get back to you in 2-3 business days.

See Why Top Companies Choose DailyPay

Empowering for Employees

Greater financial control with access to 100% of their DailyPay balance to meet the challenges of unexpected financial disruptions.

Improved planning with visibility to spending and earned pay in one easy-to-use app.

No need for a pre-existing checking or savings account.

Simple and Secure for Employers

No change to payroll processes — DailyPay compliantly handles it all.

Seamless integration with HCM, payroll, banking and benefit applications.

Enterprise-grade platform that keeps data private and the service running so it's always there when your employees need it.

* On-Demand Pay requires employer participation in DailyPay. On-Demand Pay fees will be waived for any DailyPay transfers made to a DailyPay Card set up with direct deposit.

** Instant transfers may not be available to residents in all states.

¶ Cash Back rewards earned on qualifying purchases will generally be transferred to your Card Account within 49 days after the qualifying purchase is settled. If you close your Card Account, any earned Cash Back rewards not yet transferred to your Card Account will be forfeited. See the DailyPay Cash Back Program Terms & Conditions for full details.

The DailyPay Visa® Prepaid Card is issued by The Bancorp Bank, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc. and can be used everywhere Visa debit cards are accepted.

Your funds are FDIC insured through The Bancorp Bank, N.A., Member FDIC. DailyPay is not FDIC-insured. Deposit insurance coverage only protects against failure of The Bancorp Bank, N.A.

DailyPay, LLC's Earned Wage License Number in Wisconsin is 2587396EWA.

DailyPay, LLC's NMLS ID is 2587396.