On-demand pay, also called earned wage access, is a voluntary benefit that allows employees to access their earned and unpaid wages prior to payday. Allowing employees to tap into their earned pay empowers them to pay their bills on time and meet unexpected expenses, without having to pay late fees, overdraft fees or predatory payday loan interest, which can be as high as 400%. The ability to transfer earnings before payday also allows employees to stress less while on the job because they feel more financially secure, which increases their productivity and employee engagement.

When employers look at this benefit, it’s a good idea to make sure that any on-demand provider you’re considering offers an app to employees for easy access to their earned pay. Millennials and Gen Z comprise almost 75% of the current workforce, and these employees use an app for practically everything in their lives.

Here are some of the characteristics you might consider when looking at different on-demand pay apps offered by on-demand pay providers:

How fast can your employees receive their earned income after requesting it?

Many apps allow instant access to an employee’s earned income, sometimes called earned wage access, while others only offer next-day access to earned income. Some apps offer both of these features.

When evaluating providers, it’s important to consider the needs of your workforce. Sometimes next-day access simply isn’t good enough. Consider, for example, one of your employees who is shopping at a grocery store. This employee may be waiting in line and realizes that there isn’t enough money in his/her bank account to pay for the groceries. If that person has an on-demand pay app that provides instant access to his/her earned income, the problem will be solved.

As another example, take into account what would happen if an emergency arises? In an emergency, the employee may not have time to wait for their earned income to arrive in their bank account the next day. Instant access is imperative as 78% of U.S. adults living paycheck to paycheck.

Are there any limitations on employee usage of the on-demand pay app?

- Vendor-imposed limits on number of transfers. How will it affect your employees if their on-demand pay app limits the number of transfers to only a few per pay period? Think about how frequently they may actually need to make transfers. It’s their money; you might not want to have limitations on how often they can access it.

- The percentage of earned income that the employee can access. Some on-demand pay providers increase the amount of earned income employees can access the longer they use the app, or as a reward for “tipping” in exchange for accessing their pay. For example, an app may only allow access to 50% of the employee’s earned income. Others allow access to up to 100% of the employee’s net earned income, allowing for greater flexibility and control. Again, it’s the employee’s money, and if you work with a provider that can accurately calculate the employee’s net earned income, allowing 100% access shouldn’t pose any risk.

- Use it or lose it. Some apps only allow access to earned income during a certain period of time, often within a 24-hour window. If the employee does not request a transfer during that time period, then they lose availability to that day’s Pay Balance. Their money doesn’t accumulate. This does not take emergencies into consideration.These timing restrictions put pressure on employees to take money out even if they don’t need it. Rather than creating safety nets for employees, restrictions like these create added stress and reduce financial stability.

How much does it cost for employees to access their earned income?

It is important to think not only about your employee’s short-term ability to access their earned income but their long-term financial stability as well. If they are frequent users of on-demand pay apps and the cost per transfer is high, then it could do some damage to their bank account. When considering which on-demand pay app is best for your workforce, consider how much it will cost them to get their earned wages based on frequently you think they will use it. In an emergency they will likely only be thinking about how they can get access to their earned income, and not how much it will cost them.

Consider whether or not the cost is fixed or varies. Is it the same price every time an employee makes a withdrawal? Is it a subscription-based fee? How frequently you think employees might be making transfers might influence your decision. Some employees may not want to pay a monthly subscription if they do not think they will be using the app often enough to justify the subscription cost. However, they may still want access to an on-demand pay app. In other cases, a subscription cost may drive over-usage of the app because employees may want to get their money’s worth. Whether or not a subscription cost is best for your company depends on the frequency in which your employees want to be paid.

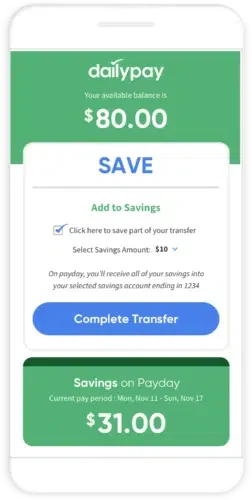

Does the instant pay app offer money management features?

Many on-demand pay apps offer additional features in addition to access to earned income. The long-term goal of an on-demand pay program should be to build financial stability and provide a path to financial wellness. Some on-demand pay apps have savings features that allow users to put their earned wages into a savings account instead of their checking account.

- The ability for the employee to save in their own interest-bearing account (not the vendor’s account).

- Access to an employee’s savings, whenever they need it.

- The ability to save in a number of ways to facilitate the habit of saving and, consequently, the employee’s health and security.

Not all instant pay apps offer the same benefits to employees. You will want to look for the one with the most flexibility, so that your employees have access to 100% of their accumulated earned income, whenever they need it. It’s recommended that you conduct thorough due diligence to choose the best app and provider for your employees.