Good Business Starts With Employee Financial Wellness

Today’s top companies are reimagining payroll to outpace competitors and retain employees longer.

By offering DailyPay, employees can access their pay as needed. Employers can support employees with full pay transparency that allows them to better plan their lives and manage financial disruptions.

This increased visibility and control is why 52% of users say their opinion of their employer has improved since they began using DailyPay.1

1 DailyPay User Survey, November 2022

On-Demand Pay Gets Employees to Stay

DailyPay’s core capabilities allow employees to better their financial wellness by equipping them with simple-to-use tools that empower visibility and control of their earned pay.

93%

of employers who offer earned wage access say it helps them retain talent.2

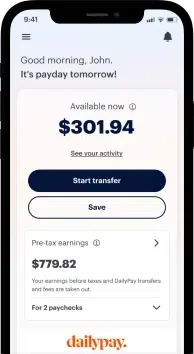

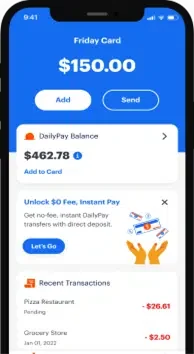

Pay

Employees have no-fee ways to access their earned pay as needed.2

Save

Employees are provided with simple and efficient ways to save in just a few taps. They can enroll in auto save or choose to manually set aside cash each week.

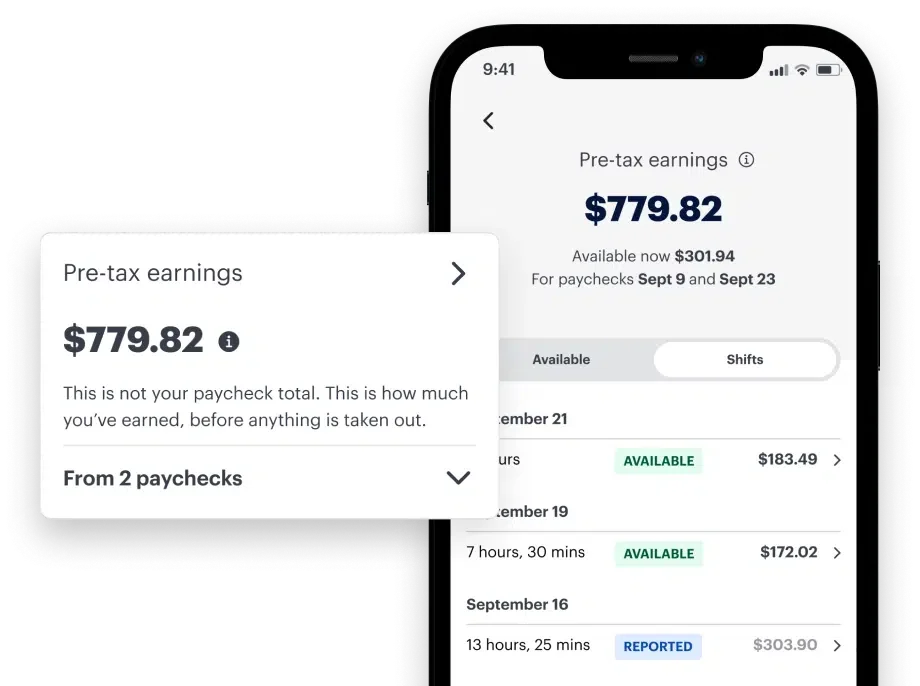

Track

Employees get full transparency to their earnings in real time. They can track every penny earned and shift worked, with the ability to see pre-tax earnings and how their available balance is calculated.

Learn

Employees get access to free financial counselors whenever they need. They also get access to our Financial Wellness blog and email newsletter.

What is an Employee Retention Strategy?

Employee retention is the percentage of employees who remain with an organization year to year. The percentage of employees leaving an organization determines the turnover rate. As companies look to increase employee retention, a total reward package including on-demand pay contributes to strong retention.

A strong employee retention strategy aims to increase a company’s yearly retention by providing methods to improve employee morale and encourage employees to remain at the company. Methods to develop an employee retention strategy may include:

Increasing employee incentives

Improving financial security

Defining clear career paths and growth opportunities

Organizations that don’t have an effective employee retention strategy may suffer from high turnover and the associated adverse effects that impact culture, revenue and customer service.

Common Methods to Improve an Employee Retention Strategy

A comprehensive rewards and recognition program can improve employee retention strategies, reducing the employee turnover rate. This may also be referred to as a total rewards program and should include:

Compensation not only involves how much an employee gets paid but how often. Employees dealing with financial stress will see negative effects on performance and productivity.

A comprehensive benefits package that goes above and beyond competitors will give a hiring edge and contribute to employee appreciation and retention.

Employees are looking to improve their work/life balance and reduce their stress levels. When employees are dealing with personal or financial stress, they may perform their job poorly with less efficiency.

Empowering employees financially sets them up for success and helps them develop healthy financial habits.

Recognizing an employee for their hard work can play an important role in motivating and retaining employees.

It’s the Benefit They’re Asking For

American battery manufacturer Duracell employs more than 3,500 people across the globe. The company’s employees asked for DailyPay by name, and its contractors wanted DailyPay before being hired full time. After thorough research and vetting, Duracell implemented DailyPay.

79% employee adoption.

59% increase in tenure for DailyPay users vs. non-users.

The Advantages of Employee-First Pay Strategies

Duracell isn’t a unique case. Regardless of industry or company size, employees are asking for and using DailyPay to enhance their financial wellness.

1 DailyPay User Survey, November 2022

2 ADP Earned Wage Access Market Research Study, March 2022

3 DailyPay analysis of Fortune 500 companies, June 2021

67%

of users say DailyPay has helped them reduce financial stress.1

59%

of employed Americans say they would benefit from getting paid more frequently.1

49%

of users say DailyPay helps them avoid late fees or overdraft fees.1

47%

of users say DailyPay has helped them avoid taking out a payday loan.1

80%

of 2021 Fortune 200 companies that offer on-demand pay partner with DailyPay.3

See Why Top Companies Choose DailyPay

Empowering for Employees

Greater financial control with access up to 100% of their DailyPay balance to meet the challenges of unexpected financial disruptions.

Improved planning with visibility to spending and earned pay in one easy-to-use app.

No need for a pre-existing checking or savings account.

Simple and Secure for Employers

Minimal change to payroll processes — DailyPay handles it all.

Seamless integration with HCM, payroll, banking and benefit applications.

Enterprise-grade platform that keeps data private and the service running so it's always there when your employees need it.