How often you pay employees is a business decision determined by individual companies. The restrictions and parameters include federal and state laws, the cost of running payroll and your employee’s financial well-being.

These determining factors don’t always work well together, especially when it comes to taking into consideration the financial wellness of your staff.

The Most Common Payroll Frequencies

In an effort to toe the line between business and staff needs, most businesses select from the following, traditional, options:

- Weekly pay, which means employees receive 52 paychecks a year.

- Bi-weekly pay, which means employees receive 26 paychecks a year.

- Semi-monthly pay, which means employees receive 24 paychecks a year.

- Monthly pay, which means employees earn 12 paychecks a year.

Selecting the right cadence for payroll is always a delicate decision. The difference between 52 and 12 paychecks a year has many implications for both the employee and the employer. The bi-weekly pay period is the most common, followed by weekly, then semimonthly, then monthly. According to the BLS, 43% of employees receive their paycheck bi-weekly, making it the most popular pay frequency. 33.3% of employees receive weekly paychecks, making it the second most popular frequency. There are pros and cons for both weekly and bi-weekly pay frequencies.

Pay Frequency From a Business Perspective

Businesses need to be aware of their spending when it comes to processing payroll. Common costs associated with payroll include:

- Printing checks for employees

- Direct deposit costs, charged by banks

- Employee or bookkeeper’s time to calculate payroll

- Third-party costs for running payroll, if you outsource

The more a business runs payroll, the more it will cost. For this reason, it becomes tempting to consider semi-monthly or monthly pay frequencies. Those schedules aren’t favorable for employees though.

Pay Frequency From an Employee’s Perspective

On the flip side of the coin, employees want access to their earned income. It’s likely that bills and unexpected costs of daily living happen more frequently than semi-monthly or monthly schedules. Having money on hand can mean the difference between paying a late fee or not for your employees.

Financial stress is common, too.

An Employee Financial Wellness Survey, conducted by PricewaterhouseCoopers (PwC) this year, provided some meaningful insights:

- 57% of workers say their finances are their top cause of stress

- 53% of workers say they are most worried about their expenses increasing

- 74% of workers seek financial guidance when dealing with financial decisions, crises or life events.

The faster your employees can access their earned income, the more peace of mind they will have.

And, if it weren’t for costs associated with running payroll frequently, business owners would be more open to a faster payroll cycle. Unfortunately, until recently, this concept hasn’t been realistic. But things have changed.

Additional Reading: HOW FINANCIAL WELLNESS IMPROVES EMPLOYEE ENGAGEMENT

Earned Wage Access as a Financial Wellness Strategy

Some businesses opt for financial wellness programs that include financial advisors or budgeting consultants. While this can be a great fit for some employees, others feel embarrassed by their finances, or lack of monetary aptitude and will avoid these types of programs. The enrollment rate is not as high as it could be.

Employees would rather have more control over their finances on their own. This mentality is catching the attention of many employers.

As technology advances, it becomes easier for businesses to take on this “pay as you earn” mentality.

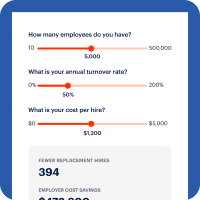

DailyPay makes it easy to integrate earned wage access technology with existing payroll processes, without disrupting the flow. DailyPay allows your employees to access their earned pay before the traditional, scheduled payday. It works with any payroll system that currently offers direct deposit. When an employee wants to access their earned income, it will deduct from their next paycheck. It’s not a pay advance or a payday loan because the income has already been earned.

Payroll systems run as they normally would. So, even if you ran a semi-monthly or monthly payroll, your employees don’t need to abide by the payroll schedule. The next pay period an employee would receive their total, minus what they deducted before payday.