Public Sector

Unlock Financial Wellness for Public Sector Employees

Improve government employee retention with DailyPay – the #1 adopted employee financial wellness benefit.

Here's a look at the types of government organizations we support:

We Are the #1 Most Adopted Financial Wellness Benefit

benefits for the public sector

The Future of Employee Pay

A financial wellness platform designed for the unique challenges of the public sector.

How Does DailyPay Help the Public Sector?

DailyPay is more than just On-Demand Pay. We give public sector employees access to their earned pay before the traditional payday and provide a suite of financial wellness tools.

The public sector must set itself apart from other industries and attract and retain the next generation of workers.

Fast and easy implementation

Reduce operating costs

Runs with all major payroll systems

97%

of companies offering earned wage access (also known as On-Demand Pay) agree that it’s helping attract and retain the right workforce for the future of their organization.1

86%

of companies with an earned wage access solution believe it is helping them stand out from the competition.2

1, 2 Hanover Research Study: Companies with EWA Solutions, September 2023

Modernizing Pay to Attract and Retain Top Talent

DailyPay offers modern financial solutions that can help government agencies at all levels attract and retain top talent.

education

Improve Hiring and Retention in Your School

Schools are regularly dealing with burnout, heavy workloads, high stress, and inadequate resources. The learning environment can be enhanced when valued staff can avoid financial stress and bring their best selves to work.

To improve recruitment and retention, schools should consider how they can modernize pay practices and working conditions to improve staff well-being and retention.

Our Innovative Approach

On-Demand Pay allows employees to access a portion of their earned pay before the scheduled payday. This free benefit can help educators and hourly staff manage unexpected expenses, avoid costly alternatives, and improve employee financial wellness.

State and local government

Modernize Government Benefits to Attract the Next Generation

The state and local government workforce is shifting as baby boomers retire. Outdated financial benefits can lead to a loss of institutional knowledge and a potentially massive hiring shortage.

To get ahead of this potential shortage, state and local governments can modernize their approach to attract new talent and retain their current workforce.

Our Innovative Financial Wellness Solution

On-Demand Pay allows employees to access their earned pay before payday, addressing the financial flexibility new generations of workers expect. By offering such progressive benefits, governments can appeal to younger workers while supporting existing staff.

Federal Government

Could On-Demand Pay Solve the Federal Government's Recruitment Crisis?

The federal government often struggles to fill open roles and recruit for key positions. Attractive benefit packages with a focus on financial wellness can help address this challenge.

Our Innovative Solution

On-Demand Pay, which allows employees to access their earned pay before payday. By offering this kind of benefit, the federal government can appeal to candidates seeking both stability and flexibility—potentially easing long-standing recruitment struggles.

Here’s What Industry Leaders Say About DailyPay

My experience with DailyPay has been wonderful from a customer service perspective. I always felt like I had someone to contact, and I always knew who I could reach out to. The implementation process was relatively seamless based on the software platform partnership we have in place.

Karen Husick

Director of Payroll, Cornell University, Inc

It was probably the easiest implementation I’ve ever gone through with any company at all, especially a new program such as this. DailyPay had an implementation team that was very communicative, very timely, and made sure everything was documented appropriately.

Saundra Hester

Senior Director of Payroll, Duke University & Health System

How DailyPay Works

A seamless process for providing early access to earned pay.

1

Employees complete a work shift.

2

DailyPay calculates employees’ shift earnings and makes a portion of their earned pay available to them.

3

Employees can access earnings instantly for $3.49.#

# Fees vary by employer

4

Any earnings that aren’t accessed early are automatically paid on payday like normal.

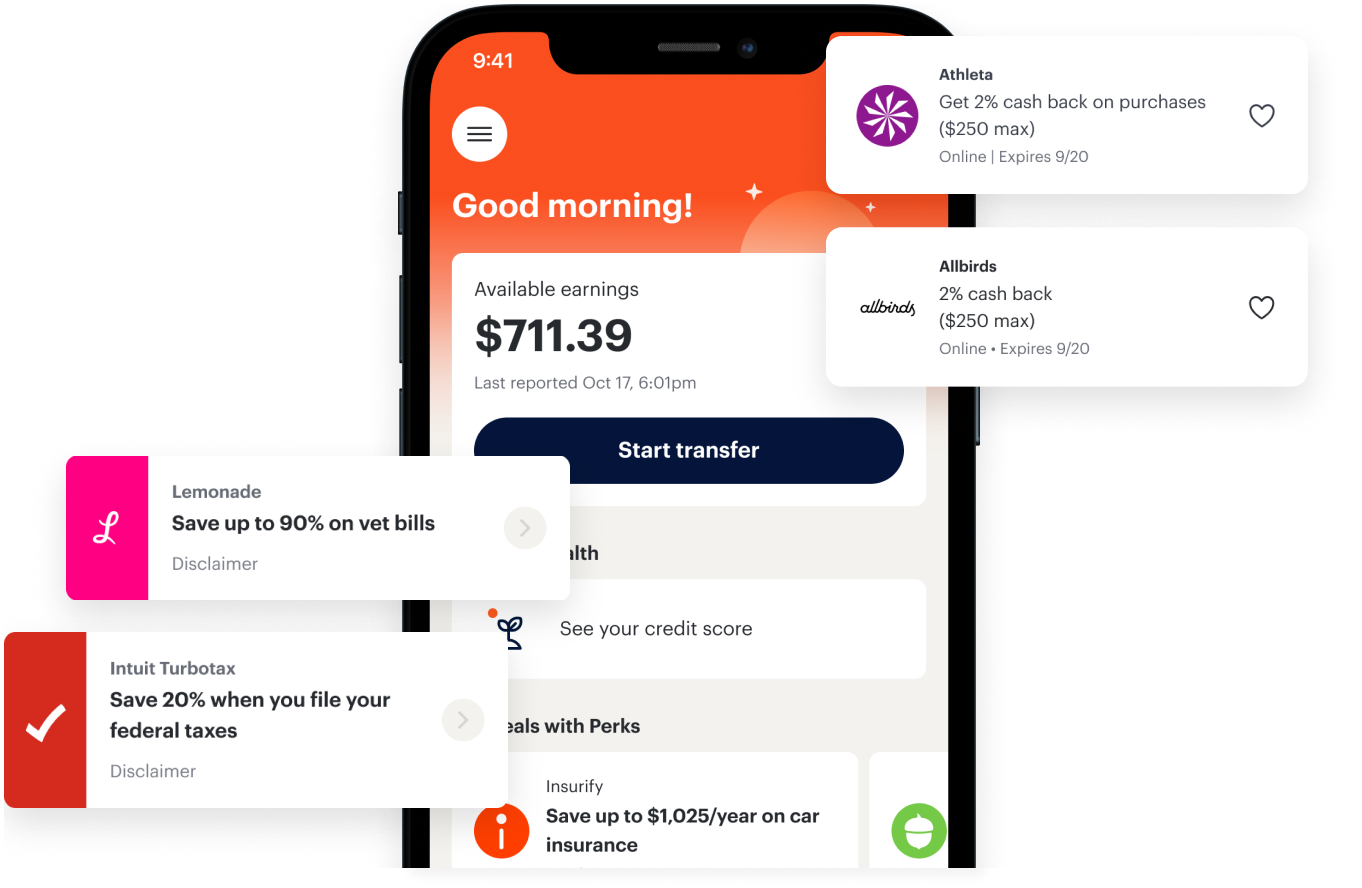

Features For Employers and Employees

Elevate your manufacturing floor by prioritizing your team’s financial wellness.

Empower Your Employees

On-Demand Pay

Track earnings per shift and access earned pay within 1-3 business days for no fee, or instantly for a flat fixed transfer fee.

Anytime access to earned pay.

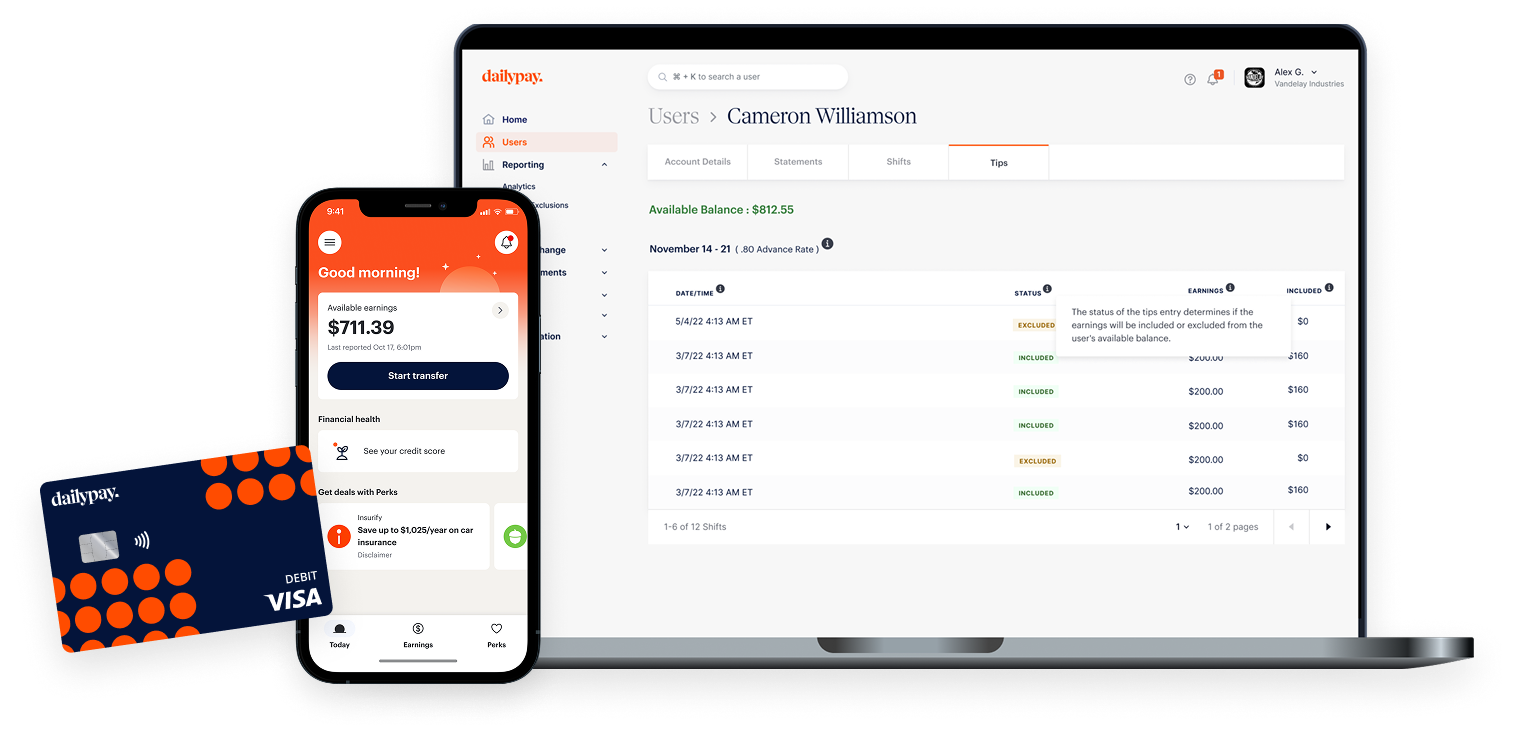

DailyPay Prepaid Visa® Card

Unlock more than just instant, no-fee access to earned pay. Enjoy cash-back¶ rewards and Savings jars.

Instant, no-fee* access to earned pay.

Credit Health

Track progress, protect from fraud, and prepare for the future with no negative impact to credit score.

Monthly free credit checks and credit monitoring.

Enhance Your Business

Cycle

A paperless and cost-effective way to disburse same-day termination pay and payroll corrections to any employee account.

Digitally send off-cycle pay to any employee, whether or not they use DailyPay.

Portal

Your central hub for program management plus access to the Success Hub, where you can find all resources needed for success.

Track program performance and usage to easily manage, measure, and optimize.

Reward

An impactful, customizable, scalable, and measurable solution for creating targeted recognition programs. Send same-day cash and motivate employees.

Reward employees in the moments that matter with real-time, digital bonuses.

Government Payroll Integration Simplified With DailyPay

DailyPay integrates with public sector payroll systems like ADP, Workday, and 180+ HCM, payroll, and time management systems to deliver its industry-leading financial wellness platform to millions of users. Partnering with DailyPay does not add an extra burden for your team. We take pride in handling the work of getting DailyPay up and running for you.

Resources for Public Sector

You Asked, We Answered.

-

How can the public sector improve retention?

Public sector organizations may improve government employee retention through higher compensation and desirable benefits such as On-Demand Pay through DailyPay.

-

What causes high turnover rates in the public sector?

Turnover can be high for various reasons. For example, teacher burnout may contribute to the teacher shortage and turnover rates.

-

Which public sector employees can benefit from On-Demand Pay?

On-Demand Pay can be offered by various public sector organizations to their workers, including education (public schools and universities can provide On-Demand Pay to teachers, administrative staff, and support personnel), Healthcare (public and university hospitals and healthcare facilities can offer On-Demand Pay to nurses, doctors, technicians, and other healthcare professionals), Public Safety (law enforcement agencies, fire departments, and emergency services can utilize On-Demand Pay for their employees, including officers, firefighters, and paramedics), Government Services (local, state, and federal government agencies can provide On-Demand Pay to their employees, including clerical workers, maintenance staff, and public service officials), Public Transportation (employees in public transit systems, such as bus, subway, and train operators, can benefit from On-Demand Pay services). These sectors can leverage On-Demand Pay to improve financial wellness and job satisfaction among their workforce, potentially reducing turnover and enhancing employee morale.

SHRM Recertification Provider

Get SHRM certified in On-Demand Pay

Get the knowledge and insight needed to implement and promote the latest in employee pay and financial wellness. Plus, earn SHRM certification course credits.

See Why Top Companies Choose DailyPay

Empowering for Employees

Greater financial control with access up to 100% of their DailyPay balance to meet the challenges of unexpected financial disruptions.

Improved planning with visibility to spending and earned pay in one easy-to-use app.

No need for a pre-existing checking or savings account.

Simple and Secure for Employers

Minimal change to payroll processes — DailyPay handles it all.

Seamless integration with HCM, payroll, banking and benefit applications.

Enterprise-grade platform that keeps data private and the service running so it's always there when your employees need it.

* On-Demand Pay requires employer participation in DailyPay. On-Demand Pay fees will be waived for any DailyPay transfers made to a DailyPay Card set up with direct deposit. Instant transfers may not be available to residents in all states.

¶ Cash Back rewards earned on qualifying purchases will generally be transferred to your Card Account within 49 days after the qualifying purchase is settled. If you close your Card Account, any earned Cash Back rewards not yet transferred to your Card Account will be forfeited. See the DailyPay Cash Back Program Terms & Conditions for full details.

Cash Back offers are shown for illustrative purposes only. Cash back amounts vary and are subject to the individual terms of the retailer. See the DailyPay app for more information.