A Financial Wellness Platform from the Leader of On-Demand Pay

Companies looking to improve employee engagement, retention, and recruiting can trust DailyPay’s employee financial wellness platform, which is empowered by earned wage access.

When employees have greater access to their pay, they’re better equipped to avoid negative financial situations and stress. The increased financial wellness helps employees to feel more motivated and engaged at work.

Financial Wellness Platform That Reduces Employees’ Financial Stress

Employees are looking to improve their work-life balance and reduce stress levels. When employees are dealing with personal or financial stress, they may be unable to perform their jobs to the best of their ability.

60%

of DailyPay users surveyed say that DailyPay helps reduce their financial stress.1

82%

of employees agree that financial wellness programs improve job performance.2

1 DailyPay User Survey, August 2023

2 UBS Workplace Voice 2023

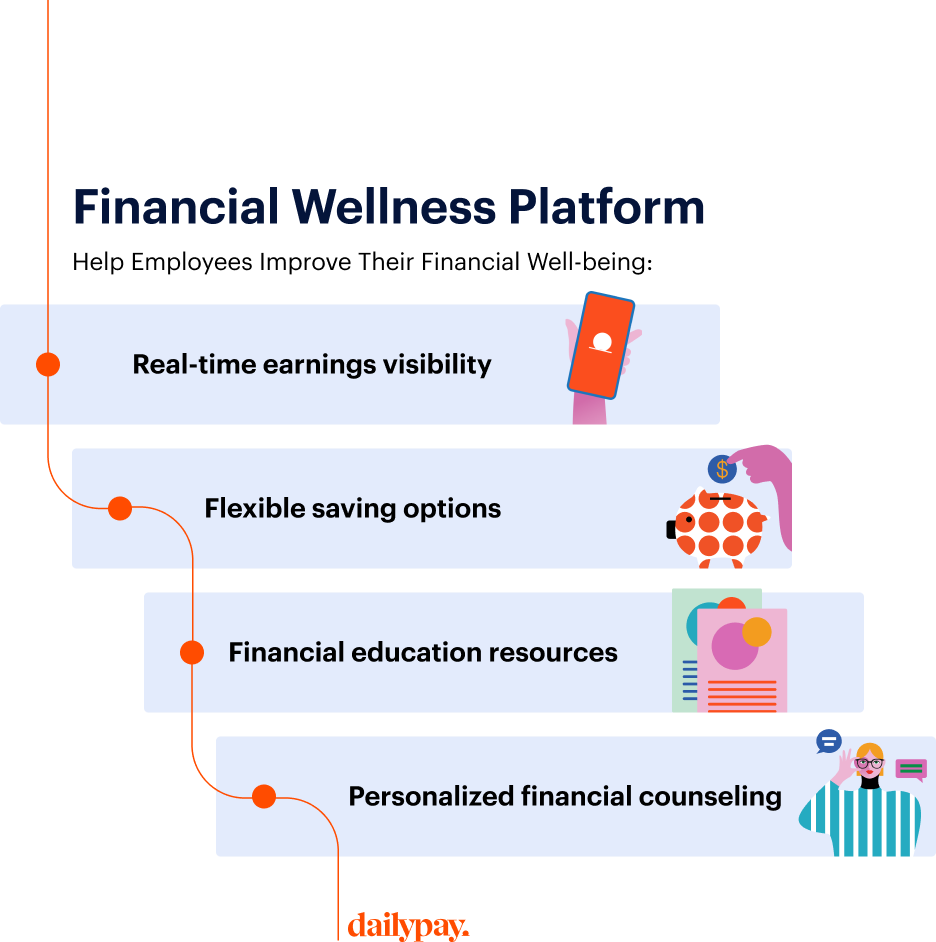

Help Employees Improve Their Financial Well-being

Employee financial wellness is an employee’s ability to effectively manage their finances. The best way to make good financial decisions is to be prepared for emergencies, spend within means, plan for the future and utilize available financial tools and information.

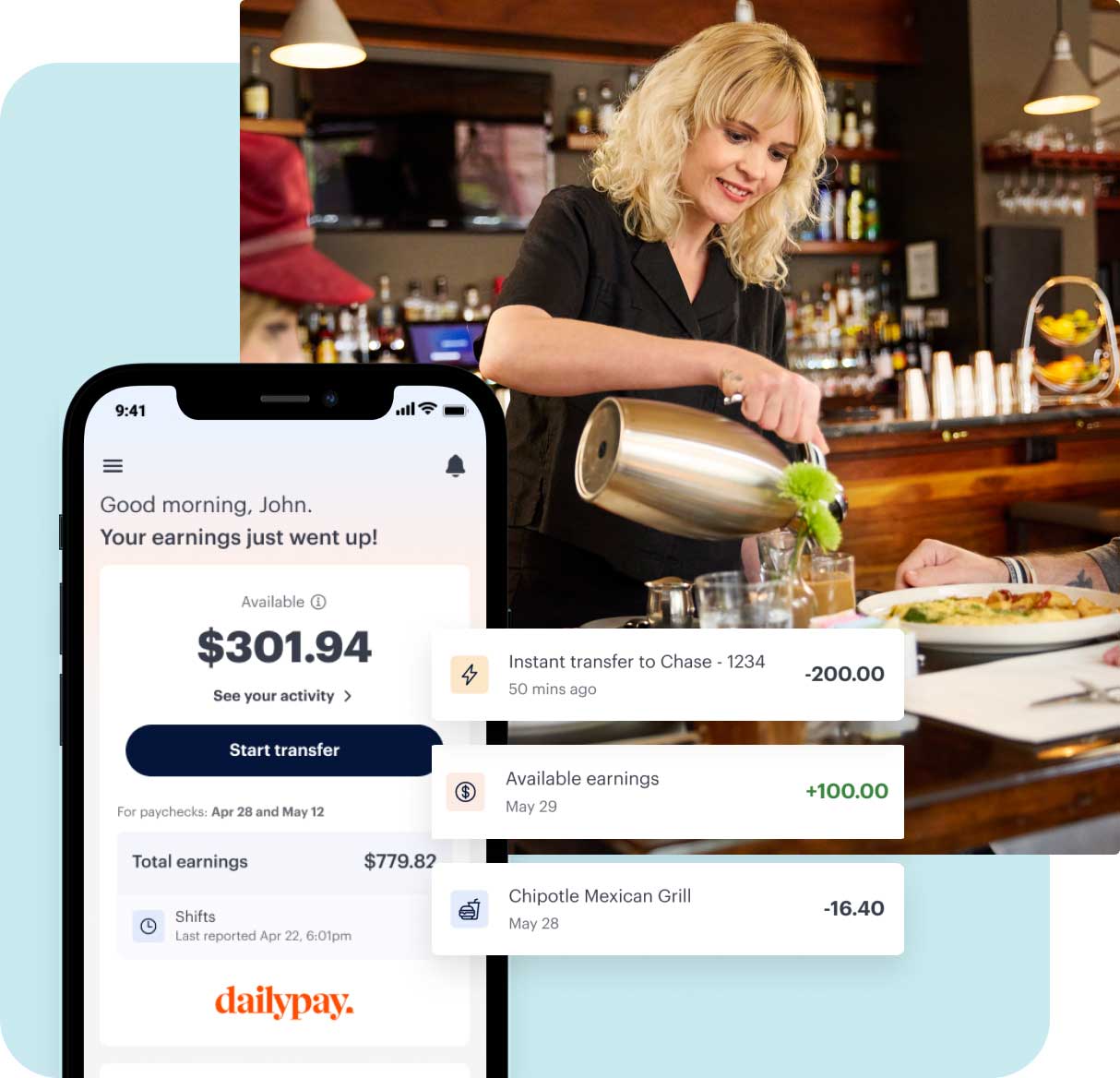

Real-time earnings visibility

DailyPay allows users to track their money as they earn it. Users can see how much they've earned each day and their available balance.

Flexible saving options

By using our Save feature, users can plan and set aside money for payday — either one time or automatically.

Financial education resources

DailyPay provides users with free in-app financial content, including ways to improve savings and more.

Personalized financial counseling

The DailyPay platform assists users in learning about financial wellness with no-fee financial counseling provided by the Coordinated Assistance Network (CAN).

The Benefits of DailyPay’s Financial Wellness Platform

DailyPay helps employers offer modern financial wellness benefits to their employees.

Support employees with financial wellness benefits to increase employee engagement and fill open roles.

Learn how earned wage access can help

3 Hanover Research Study: Companies with EWA Solutions, September 2023

4 Source: Bank of America 2022

5 DailyPay Employee Experience Research, Arizent study commissioned by DailyPay, September 2023

97%

of companies with an EWA solution indicated employee financial wellness has a positive impact on productivity.3

84%

of employers now say that offering financial wellness tools can help reduce employee attrition.4

72%

of DailyPay users say that DailyPay helps them feel more confident in managing their finances.5

Financial Wellness Platform Components

EWA: Earned wage access (EWA) — also known as On-Demand Pay — gives employees access to their earned pay before the traditional, scheduled payday.

Reward: Recognize employees with real-time digital payments.

Tips: DailyPay Tips helps organizations eliminate the administrative costs of actively managing cash on hand, manual reconciliations and reporting.

Save: Employees can send a portion of pay to a savings account each pay cycle via multiple options.

Learn: Financial wellness education and counseling from DailyPay equip users to increase their financial literacy and reduce financial stress.

See Why Top Companies Choose DailyPay

Empowering for Employees

Greater financial control with access up to 100% of their DailyPay balance to meet the challenges of unexpected financial disruptions.

Improved planning with visibility to spending and earned pay in one easy-to-use app.

No need for a pre-existing checking or savings account.

Simple and Secure for Employers

Minimal change to payroll processes — DailyPay handles it all.

Seamless integration with HCM, payroll, banking and benefit applications.

Enterprise-grade platform that keeps data private and the service running so it's always there when your employees need it.

Trusted by leading Companies