New Research Reveals Financial Concerns and Inflation Weigh on Government Employees

Despite a stable financial state for some, a majority of state & local government employees are negatively impacted by inflation and struggling to pay bills. While a decrease in inflation would offer relief, many employees face challenges due to delayed access to their earned income. Improving access to pay could alleviate financial stress and enhance overall well-being for these workers.

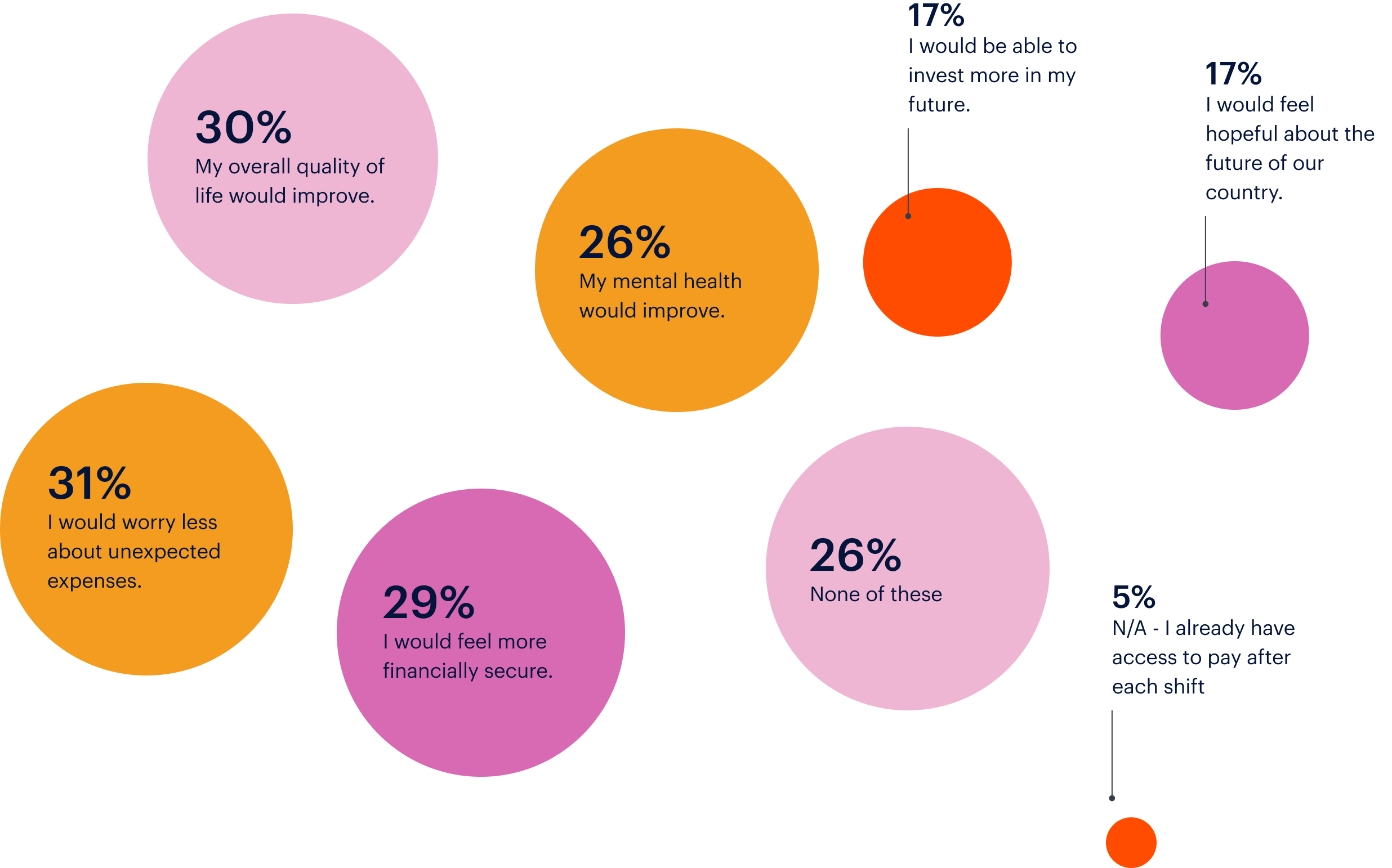

The poll also revealed that 74% of state & local government workers believe having access to their pay means more than the ability to pay bills, it has a positive impact on their wellbeing. 30% state they would have a better quality of life, a quarter (26%) feel their mental health would improve, and 17% would feel more hopeful about the future of our country.

Inflation's Impact on State & Local Government Workers and the Benefits of Faster Pay Access

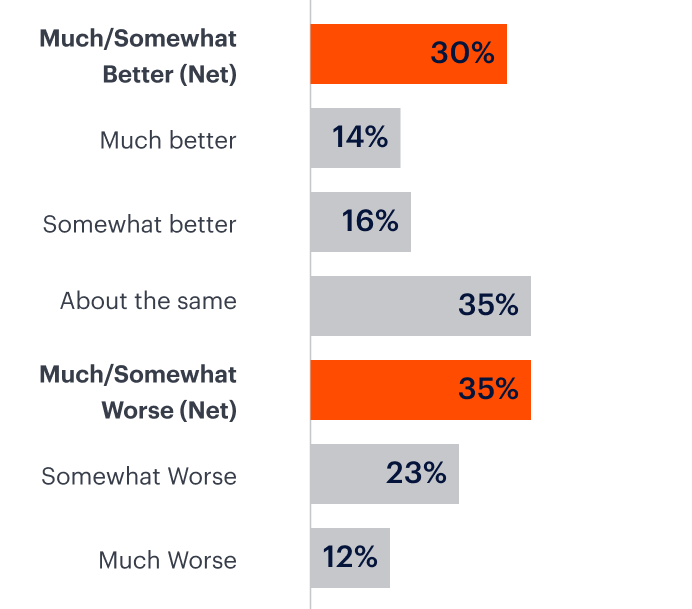

In general, how are you doing financially now compared to a year ago?

How much of a positive or negative impact has inflation (i.e., rising cost of goods and services) had on your finances in the past year?

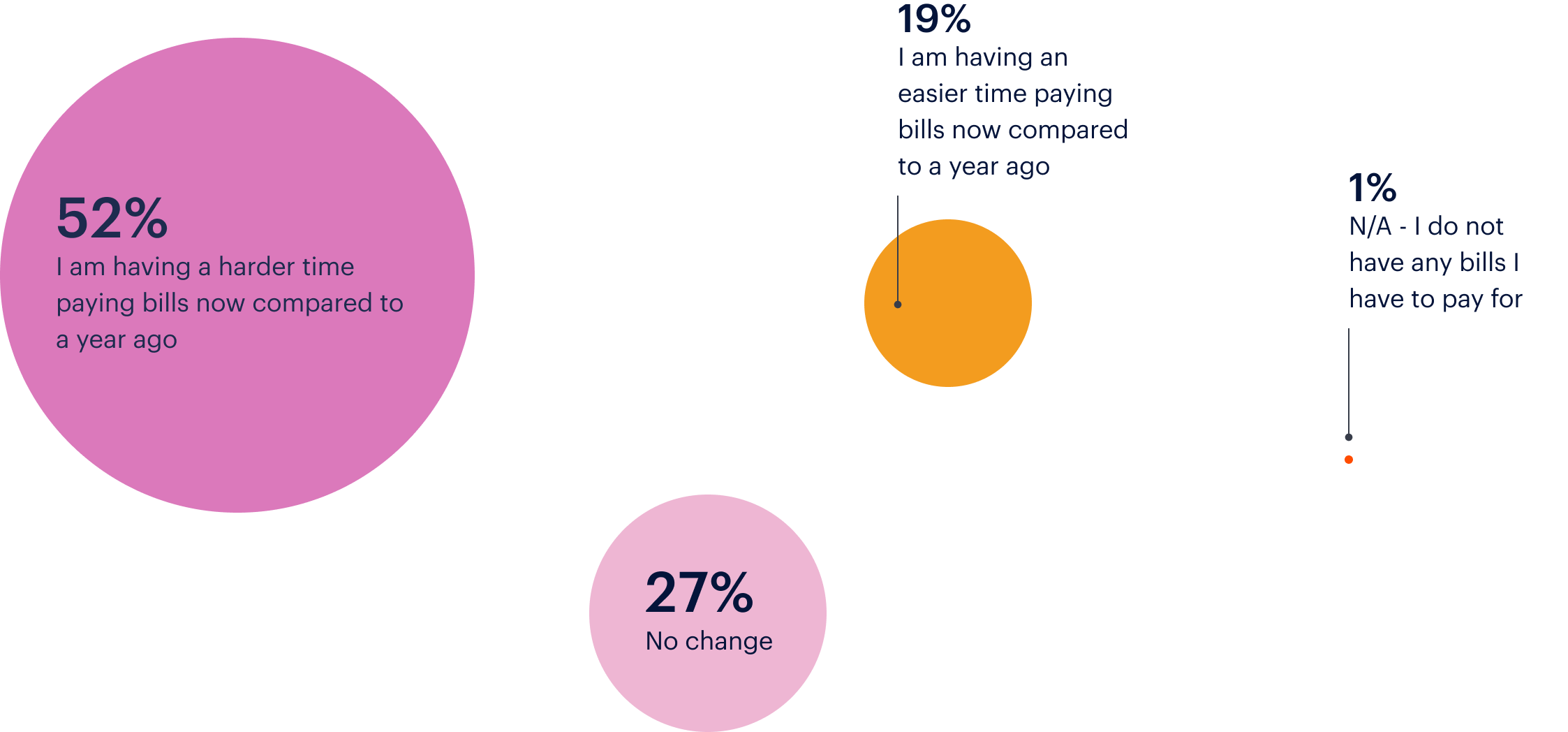

How would you describe your ability to pay bills now compared to a year ago?

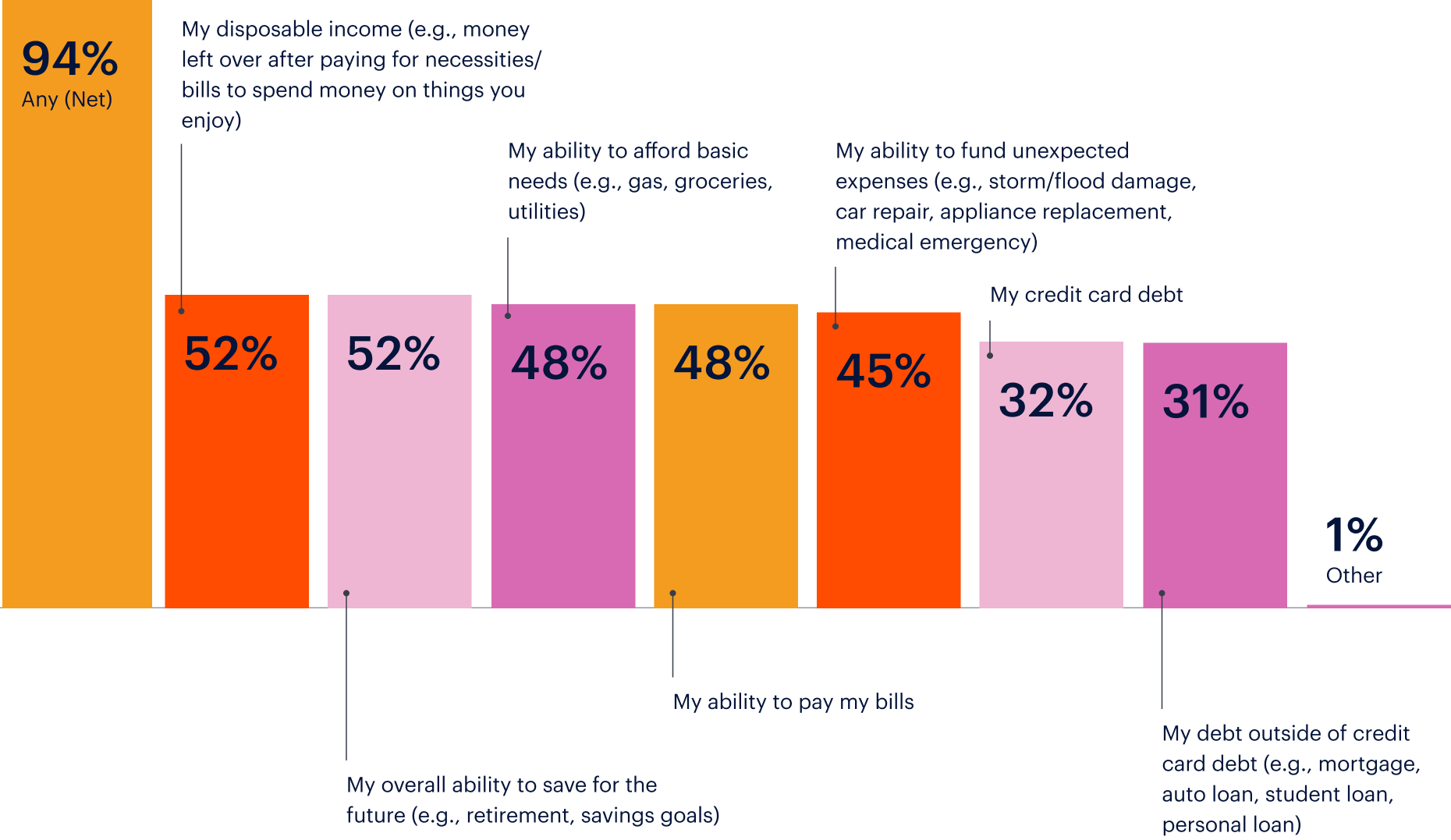

Which of the following aspects of your finances would be positively impacted if inflation continues to go down?

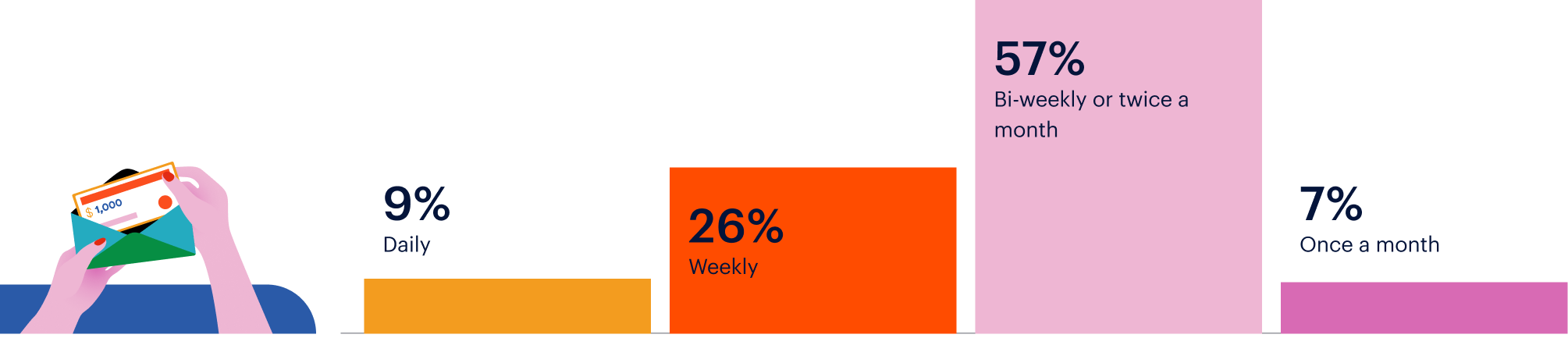

Which of the following best describes how often you get paid by your current employer? If you work more than one job, please answer for the job you work the most hours at.

If you had access to your pay when you earned it (i.e., at the end of each shift versus waiting for a scheduled payday), which of the following statements would be true for you?

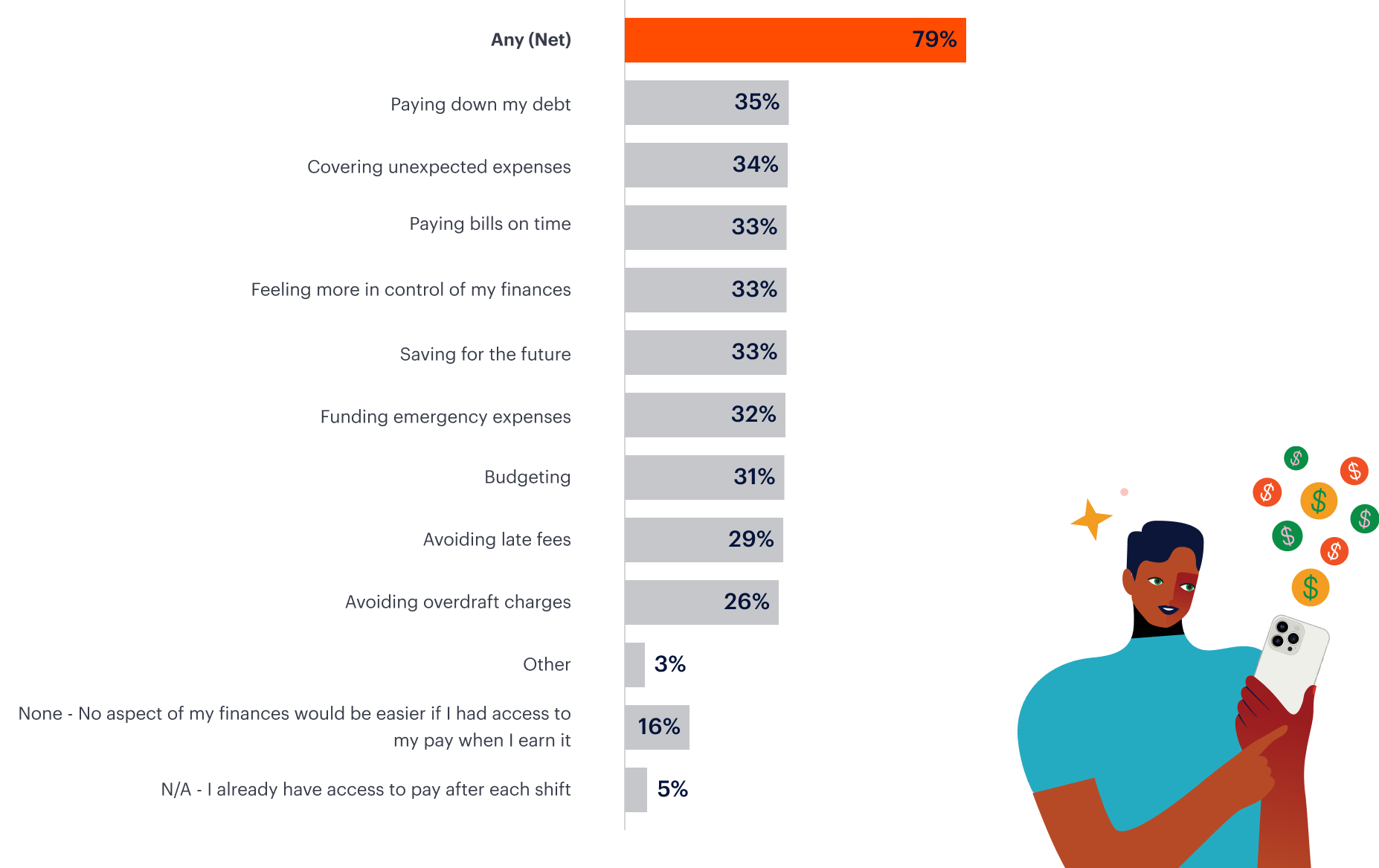

Which of the following aspects of your finances would be easier if you had access to your pay when you earned it (i.e. ,at the end of each shift versus waiting for a scheduled payday)?

Survey Methodology

This survey was conducted online within the United States by The Harris Poll on behalf of DailyPay from October 29-31, 2024 among 3,048 U.S. adults ages 18 and older, among whom 1,651 are employed FT/PT, of which 133 are state & local government employees.

The sampling precision of Harris online polls is measured by using a Bayesian credible interval.

For this study, the sample data is accurate to within +/- 2.5 percentage points using a 95% confidence level for total Americans, and accurate to within +/- 9.7 percentage points using a 95% confidence level for state & local government workers. For complete survey methodology, including weighting variables and subgroup sample sizes, please contact david.schwarz@dailypay.com.

The DailyPay Solution

DailyPay’s On-Demand Pay Platform boosts employee financial wellness and keeps them more engaged, motivated and happier at work. For employers, this translates to improved retention and increased productivity.

See Why Top Companies Choose DailyPay

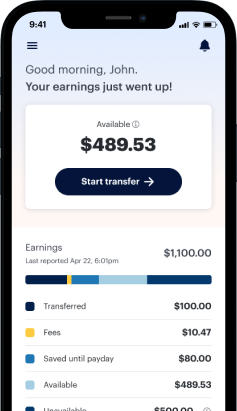

Empowering for Employees

Greater financial control with access to 100% of their DailyPay balance to meet the challenges of unexpected financial disruptions.

Improve planning with visibility to spending and earned pay in one easy-to-use app.

No need for a pre-existing checking or savings account.

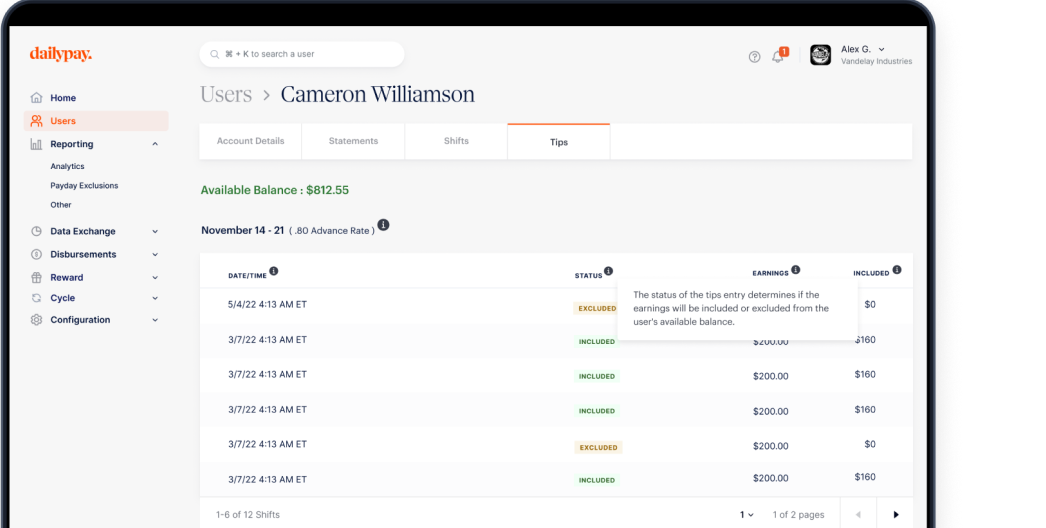

Simple and Secure for Employers

Minimal change to payroll processes — DailyPay handles it all.

Seamless integration with HCM, payroll, banking and benefit applications.

Enterprise-grade platform that keeps data private and the service running so it's always there when your employees need it.