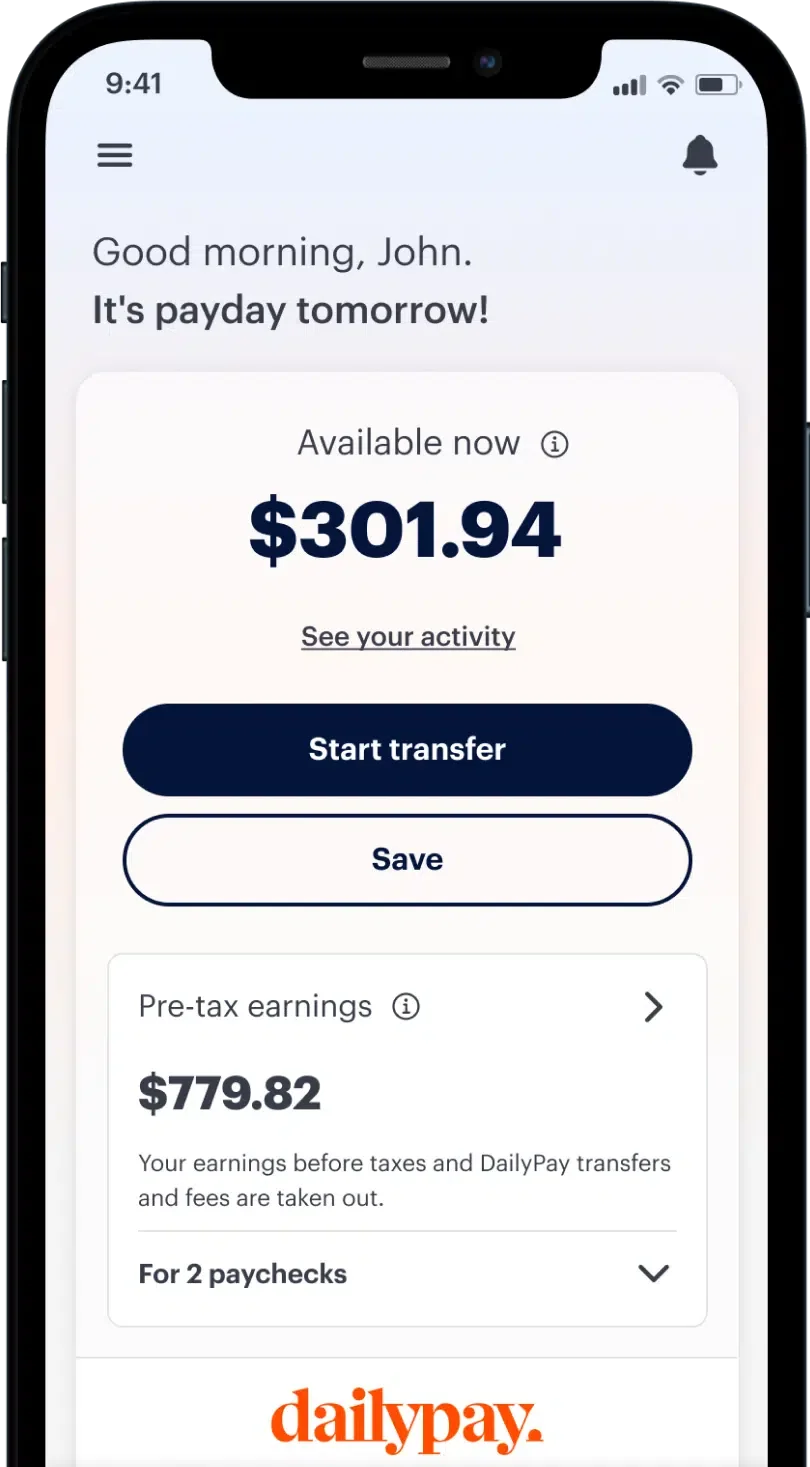

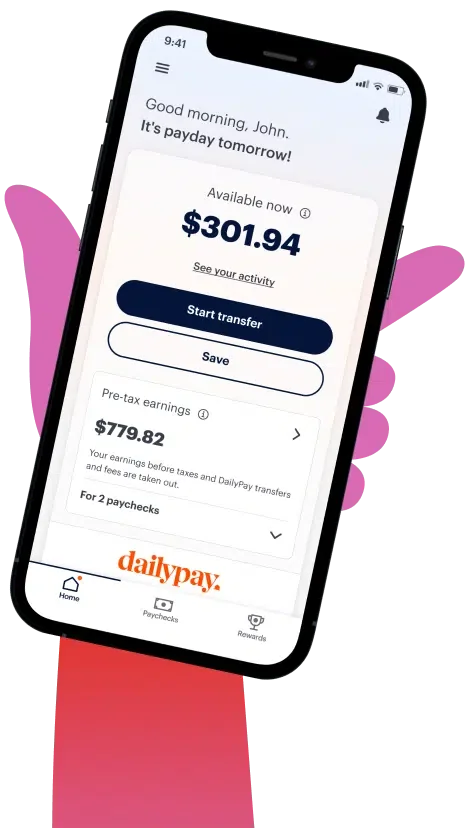

Get your pay, today. This employee benefit allows you to track, transfer, spend or save your wages as you earn them instead of waiting for payday.

Scan to get the DailyPay app

Life happens between paychecks. Get your money whenever you want.

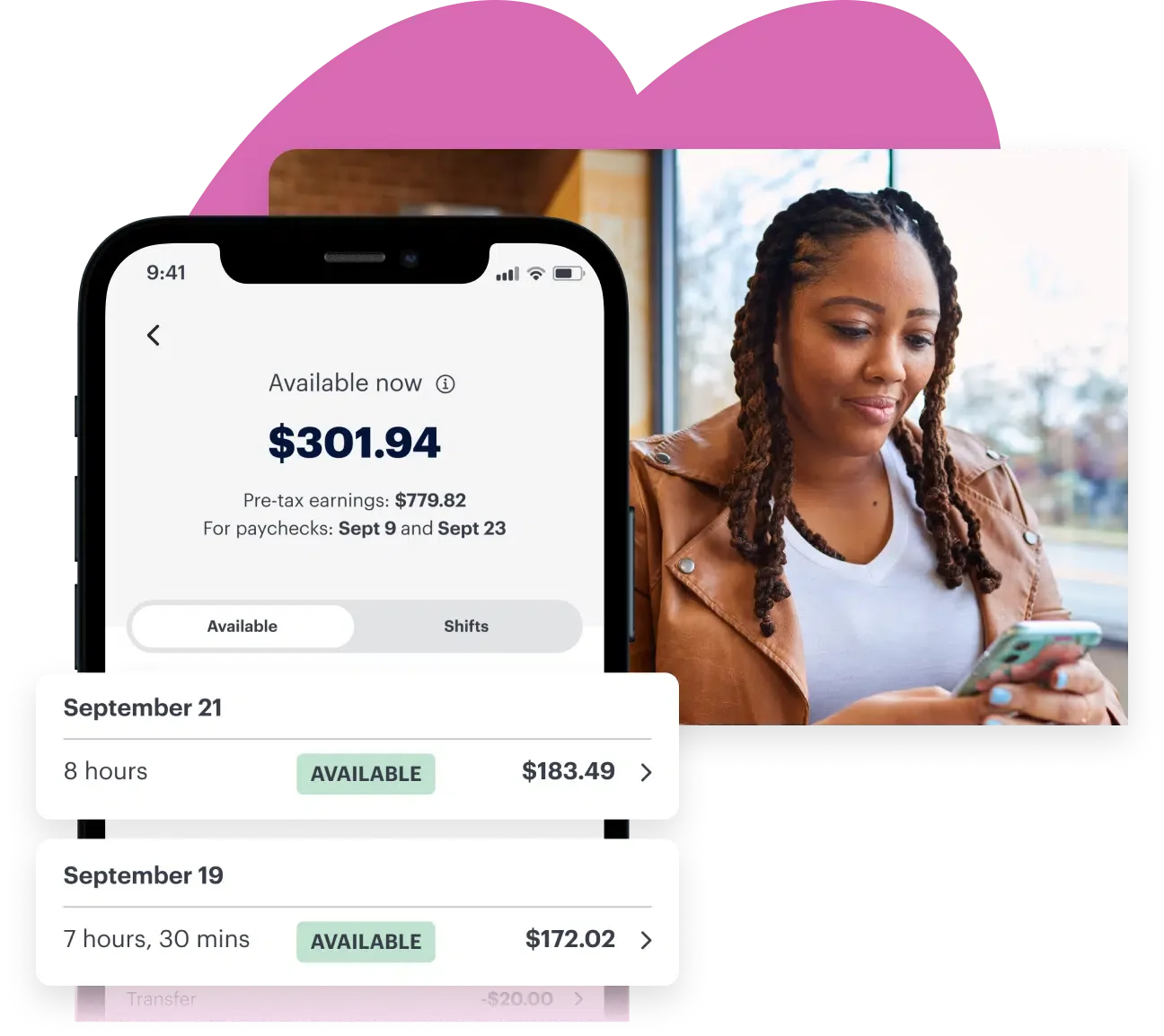

Know your pay every day and better plan your life.

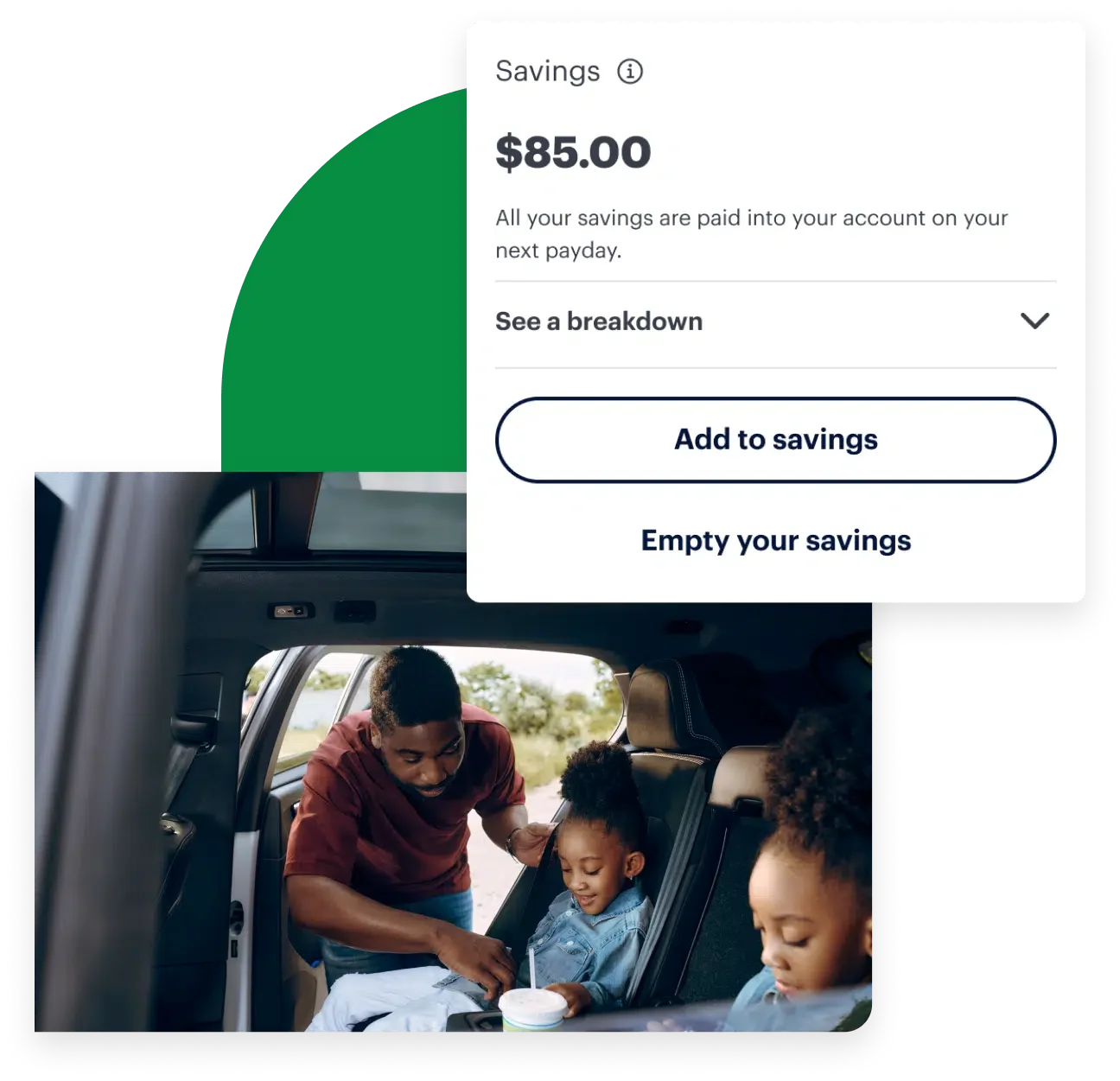

Easily make saving a habit

— for no fee.

Get no-fee, in-app financial counseling.1

There are no monthly or hidden fees. You can transfer your money next-day for no fee, or you can transfer your money instantly for $3.49 or less.2

We do everything possible to ensure your money stays safe and your data stays private.

DailyPay maintains industry standard levels of security and uses 256-bit level encryption. Our payment network and customer support channels are PCI-compliant and SOC II audited.

Join the over 2 million employees who access their earnings through DailyPay.

Love it. Makes budgeting easier.

Tara K. Call Center Agent

An emergency comes up and you need money...you get it.

Jessica N. Retail Salesperson

We've heard people say 'we come work for you because you pay us daily.'

Cindy E.

SVP Cash Disbursements,

BrightSpring Health Services

Now I don't have to wait two weeks to get paid! Especially great during unexpected expenses!

Chrystal G. Retail Salesperson

The DailyPay sign-on process was super easy.

MaryLee G. Retail Salesperson

Once again, saved from dipping into savings to cover higher prices for living expenses.

Amy D. Caretaker

Dope. If you are lucky enough to work for a company that supports DailyPay, it's an amazing app.

Matthew C. Hotel Manager

Lifesaver!

Kodi P. Line Cook

88% of DailyPay users have less trouble with bills and loan payments now than they did before using DailyPay.1

1 DailyPay Use and Impacts: A Summary of Consumer Survey Findings, Aite Group commissioned by DailyPay, June 2021

1 DailyPay Use and Impacts: A Summary of Consumer Survey Findings, Aite Group commissioned by DailyPay, June 2021

DailyPay has teamed up with hundreds of employers across the country to give you better control over your pay.

If your company offers DailyPay, you can track, transfer, spend or save your earned wages instead of waiting for payday.

Don’t see your employer?

Ask your HR department if they offer DailyPay, or

get started here.

Once your employer launches their partnership with us to offer DailyPay, you need a bank account, prepaid debit card or payroll card so that DailyPay knows where to send your earned pay. DailyPay’s software requires you to have direct deposit for your paychecks. This allows us to transfer your earned pay into your account of choice whenever you request a transfer.

DailyPay does not require you to have a social security number.

To get started, sign up here today!

No, you can discontinue using DailyPay whenever you like, without any obligation. You also are under no obligation to use DailyPay after you are enrolled. You can choose to use it as frequently as you would like once you have signed up.

When signing up for DailyPay, you will need to do the following:

1. Visit dailypay.com

2. Click “Sign up” (this is in black text at the top right-hand corner of your screen)

3. On the new page that opens, enter your name (as it appears to your employer), email address, phone number and your employee ID

4. Verify your account activation with a link that will be sent to your email address or phone number, depending on which option you choose

You can transfer up to 100% of what’s Available now in the DailyPay app. You can transfer up to five times each day or up to $1000 a day.

To create the world’s next financial system by rewriting the invisible rules of money.