Thank You for Submission

Thank you.

We will get back to you soon to schedule your demo.

Thank you for your interest in the On-Demand Pay International Council!

We will get back to you in 2-3 business days.

Pay Different: Reimagining the Payroll Cycle

Introduction

In the United States, 82% of workers earn less than $75,000 per year. Of those, 67% earn less than $50,000 per year and 58% earn less than $40,000 per year. It is well documented that hourly workers are vulnerable and experience significant hardships if faced with financial stress, particularly because of the timing of wage payment and the variable amounts earned each week. Salaried workers receive the same amount each pay period and the timing of payment is fixed. Less has been done to study the way salaried workers contend with unforeseen circumstances in between pay periods.

To understand the value and propensity to participate in an on-demand earned wage access solution, Mercator Advisory Group, on behalf of DailyPay, conducted a study of 1,000 salaried U.S. lower income workers earning less than $75,000. Although 75% of these workers are paid bimonthly (i.e., twice a month) or more frequently and 73% are paid by direct deposit into their respective bank accounts, they—like hourly wage workers—face financial strain.

Financial strain reduces worker productivity and retention. Thirty-five percent of employees report issues with their personal finances being a distraction at work. Of these, 49% report spending three or more hours a week thinking or dealing with these issues. Financially stressed employees are also more likely to leave for another employer that cares more about their financial well-being. These negatives are avoidable.

Most salaried employees surveyed believe they earn enough to pay their typical bills and fulfill their basic needs. That is, they are able to pay for basic necessities—utilities, housing, food, transportation, clothing, and medical expenses. However, many report routinely being unable to keep up when bills are higher than anticipated or unexpected expenses like paying for a health emergency arise. This creates the need to resort to creative and often expensive borrowing solutions that further deteriorate their financial situation. The survey also found that those who very rarely or never face a situation in which they run out of funds before their next payday express the desire for a more flexible paycheck.

Section One

Basics Met, but a Precarious Situation

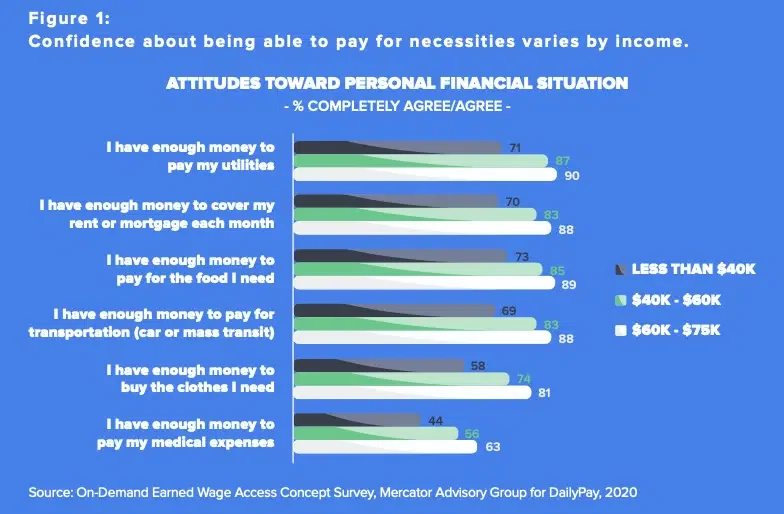

The survey participants were mostly positive about their ability to pay for basic necessities, as illustrated by the survey data presented in Figure 1. Confidence in being able to pay for utilities, housing, food, transportation, clothing, and medical expenses varied depending on the respondents’ annual earned income. Across all wage brackets, workers expressed the least confidence in having enough money to pay for medical expenses.